The information you will be accessing is provided by another organization or vendor. If you do not intend to leave our site, close this message.

Unpacking Medicare: What do I need to know about prescription drug coverage?

By Christina Joseph

By Christina Joseph

Medicare Prescription Drug Coverage - What Do I Need To Know

What do you need to know about prescription drug coverage? Let's unpack what you need to know. According to a 2016 study from the CDC 40% of people over the age of 65 take five or more medications a day. Medicare can help you pay for it. A Medicare prescription drug plan is also known as Medicare Part D. To get Medicare drug coverage you must join a plan run by an insurance company or a private company approved by Medicare. There are two ways you can sign up. The first, buy a stand-alone Medicare Part D plan. The second, purchase a Medicare Advantage plan that includes prescription drug coverage. And remember, you can only get these through private insurance companies.

Keep in mind each plan has a list of prescription drugs that it covers on a list called a formulary. The formulary has information like which tier the drug is on. Tiers help determine how much you'll pay for your medicine. The formulary also tells you about any special rules including whether there are quantity limits. You can get the most out of the Part D plan by checking different ways to save like reduced pricing at preferred pharmacies, extra benefits, or 90-day drug prescriptions. Don't forget. If you don't sign up when you're first eligible, you could pay more in the form of a late enrollment penalty. Got more questions? Learn more at AetnaMedicare.com.

Forty one percent of those over 65 take five or more medications a day.1 It’s a staggering number, but it underscores the necessity of prescription drug insurance coverage. That’s why almost 75 percent of people who are on Medicare — or more than 47 million people2 — are enrolled in a plan with prescription drug coverage.

Forty-one percent of those over 65 take five or more medications a day.1

As you figure out the best plan for your needs, here’s what you need to know about prescription drug coverage.

What does Medicare Part D cover?

Medicare Part D, also known as a prescription drug plan, helps you pay for most of your prescribed medicine. Generally, Original Medicare does not include prescription drug coverage. Learn more here about the different parts of Medicare.

How do I get Medicare prescription drug coverage?

There are two ways to get prescription drug coverage.

- You can enroll in a stand-alone Medicare Part D plan. This coverage will be in addition to Original Medicare (Parts A and B) and/or a Medicare Supplement plan.

- You can enroll in a Medicare Advantage (Part C) plan that includes prescription drug coverage. This coverage will combine your medical and prescription drug coverage.

Tip: If you don’t enroll in prescription drug coverage when you're first eligible to enroll in Medicare, you may face penalties. Find out how to avoid penalties.

Can I switch Part D plans if my prescription needs change?

Each year everyone can change their Medicare plan during the Annual Enrollment Period (October 15 – December 7). Read about enrollment periods.

There might be exceptions to these timelines if you qualify for extra help paying for prescription drug coverage. Learn about your options for assistance with Medicare costs.

What prescription drugs are covered by Medicare Part D?

Every Medicare plan with prescription drug coverage has a list of drugs — also known as a formulary — that it agrees to cover. When you research a plan, check your list of medications against the prescription drugs on your plan’s list. You’ll also be able to see which "tier" it’s been placed into. Generally, the lower the tier, the less you pay. For example, you will often pay less for a drug on Tier 1 than you would on Tier 4. The Medicare Plan Finder is a useful comparison tool you can use to plug in the names of prescription drugs and find plans in your area that will cover them. View the Medicare Plan Finder.

Your plan drug list will include both brand and generic drugs. Generic drugs have been deemed as safe and effective as brand-name medications by the Food and Drug Administration. Check with your doctor to see if a generic prescription drug is right for you.

Your plan may make limited changes to the drug list during the plan year. Plans typically don’t remove drugs from the covered drug list or move them to a higher tier during the plan year. Sometimes changes are necessary, like when a drug is found to be unsafe or is no longer available. You will be notified if this happens with one of your medicines.

How do I read a drug list (formulary)?

Your drug list (formulary) will give you the information you need to know about your drug, such as name, drug tier and requirements or limits.

How to read a drug list (formulary)

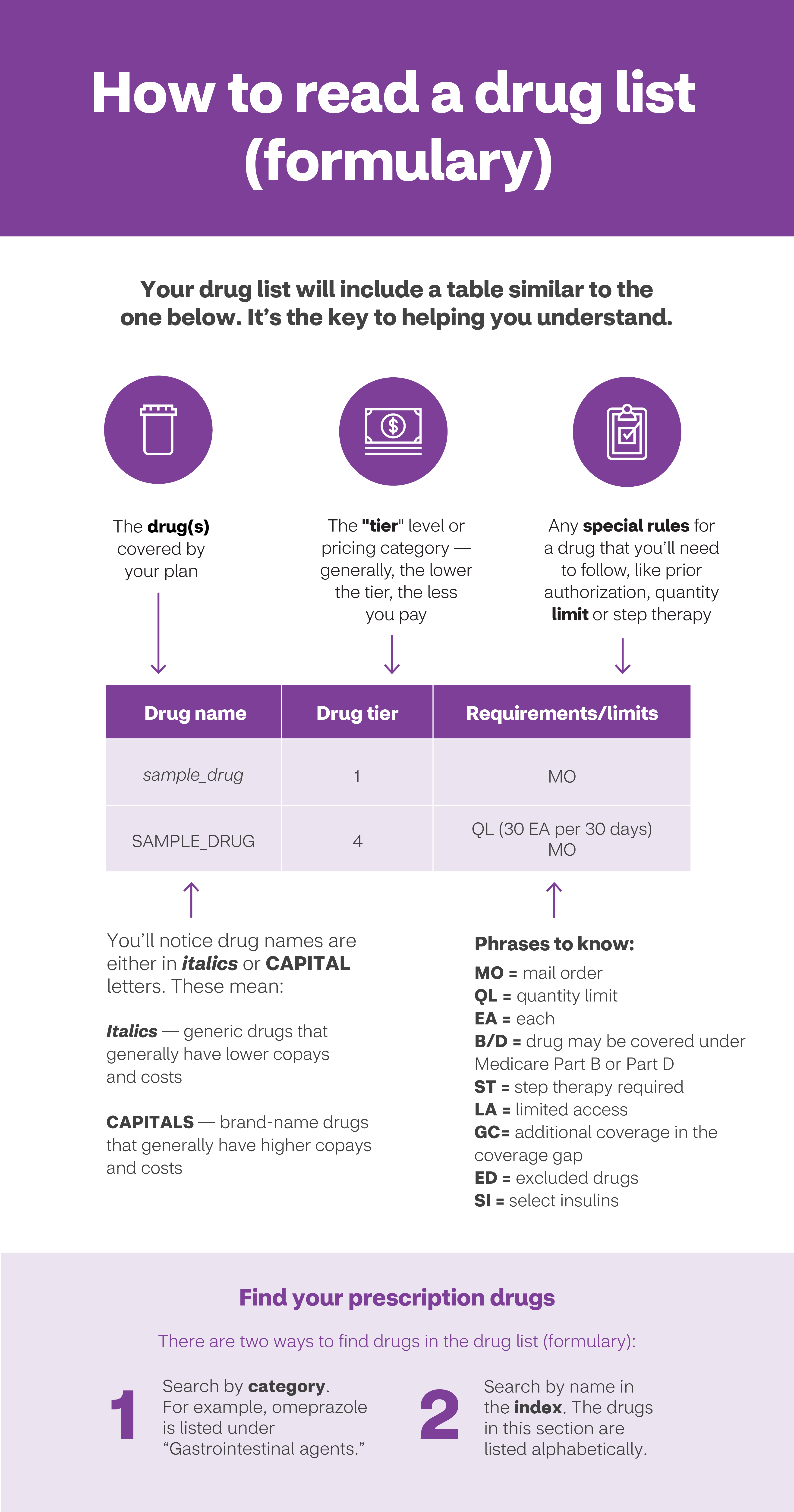

Your drug list will include a table similar to the one below. It’s the key to helping you understand.

The drug(s) covered by your plan.

Drug name:

sample_drug

SAMPLE_DRUG

The “tier” level or pricing category — generally, the lower the tier, the less you pay.

Drug tier:

1

4

Any special rules for a drug that you’ll need to follow, like prior authorization, quantity limit or step therapy.

Requirement/limits:

MO

QL (30 EA per 30 days) MO

You’ll notice drug names are either in italics or CAPITAL letters. These mean:

Italics — Generic drugs that generally have lower copays and costs.

CAPITALS — Brand-name drugs that generally have higher copays and costs.

Phrases to know:

MO = mail order

QL = quantity limit

EA = each

B/D = drug may be covered under Medicare Part B or Part D

ST = step therapy required

LA = limited access

GC= additional coverage in the coverage gap

ED = excluded drugs

SI = select insulins

Find your prescription drugs

There are two ways to find drugs in the drug list (formulary):

- Search by category. For example, omeprazole is listed under “Gastrointestinal agents.”

- Search by name in the index. The drugs in this section are listed alphabetically.

How to read a drug list (formulary)

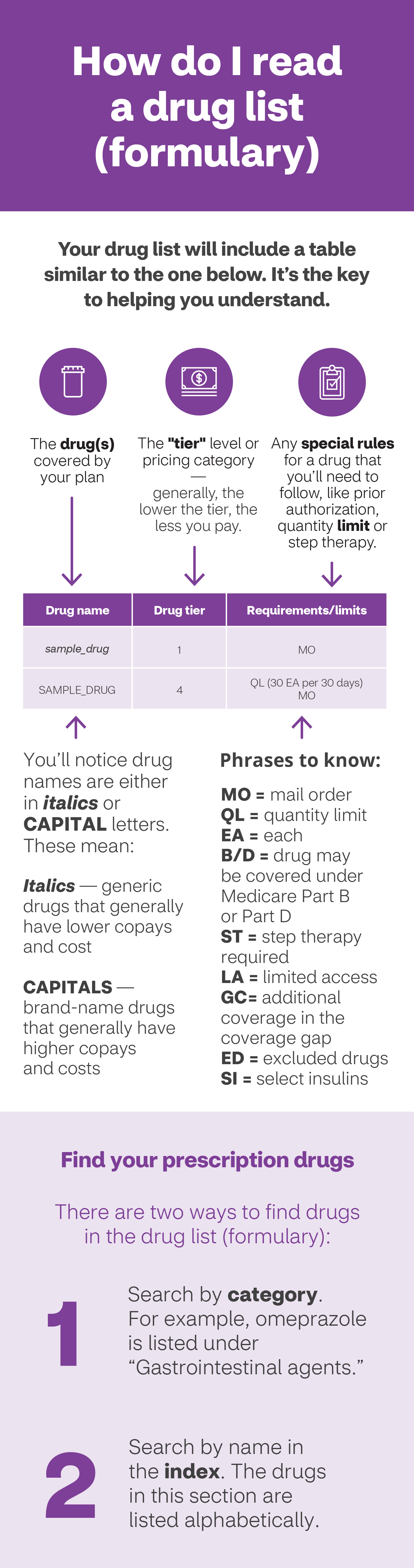

Your drug list will include a table similar to the one below. It’s the key to helping you understand.

The drug(s) covered by your plan.

Drug name:

sample_drug

SAMPLE_DRUG

The “tier” level or pricing category — generally, the lower the tier, the less you pay.

Drug tier:

1

4

Any special rules for a drug that you’ll need to follow, like prior authorization, quantity limit or step therapy.

Requirement/limits:

MO

QL (30 EA per 30 days) MO

You’ll notice drug names are either in italics or CAPITAL letters. These mean:

Italics — Generic drugs that generally have lower copays and costs.

CAPITALS — Brand-name drugs that generally have higher copays and costs.

Phrases to know:

MO = mail order

QL = quantity limit

EA = each

B/D = drug may be covered under Medicare Part B or Part D

ST = step therapy required

LA = limited access

GC= additional coverage in the coverage gap

ED = excluded drugs

SI = select insulins

Find your prescription drugs

There are two ways to find drugs in the drug list (formulary):

- Search by category. For example, omeprazole is listed under “Gastrointestinal agents.”

- Search by name in the index. The drugs in this section are listed alphabetically.

What happens if my prescription drug isn’t covered?

Medicare mandates that there be at least two drugs from every therapeutic class in a formulary. But in some instances, you may need a drug that just doesn’t make the list. If that happens, your doctor can contact the insurance company to request what’s called a “formulary exception.” Your plan will review the request to see if they'll cover it. Typically, if the drug is approved, it will be provided to you at the cost found in one of the top tiers, such as tier 4 or 5, which means you will usually be responsible for a higher percentage of the cost than if the medicine was included on a lower tier.

Understanding Medicare drug coverage phases

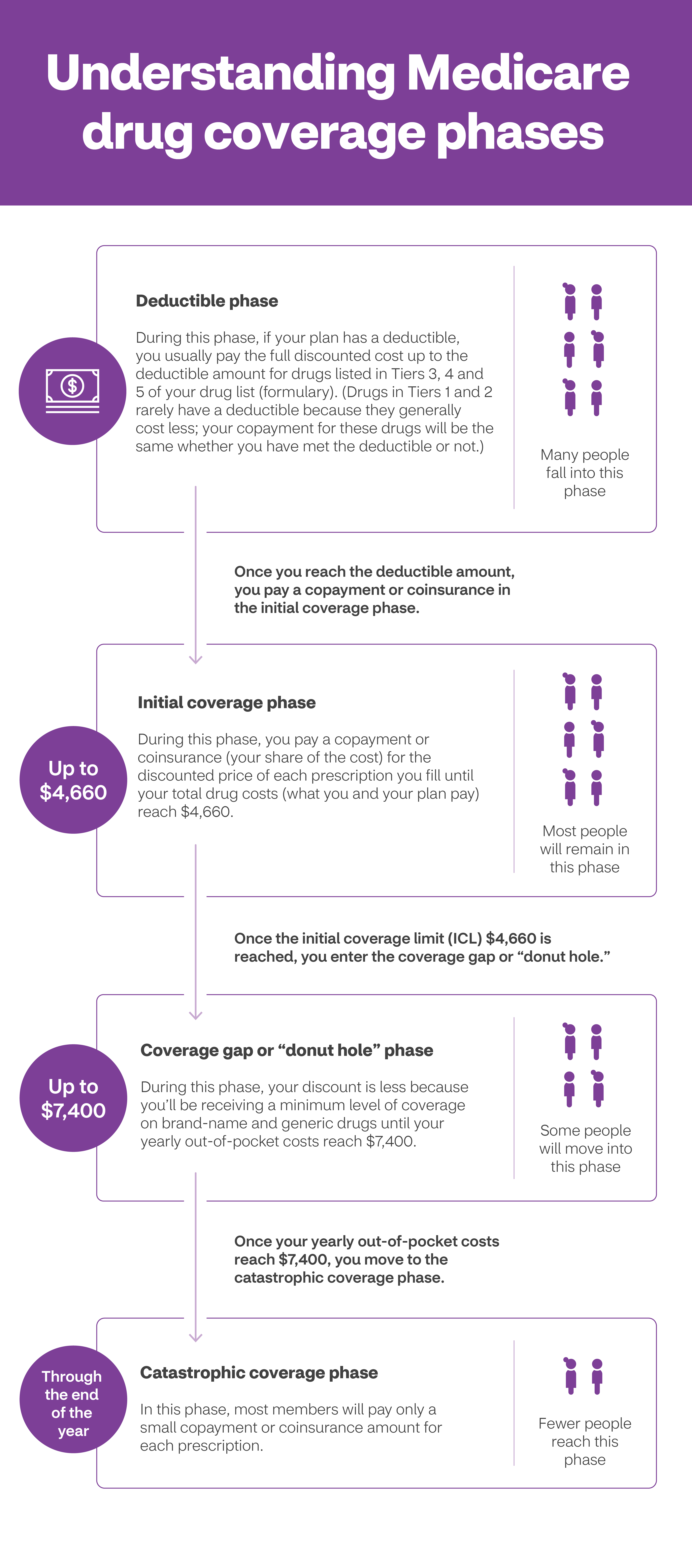

Deductible phase

During this phase, if your plan has a deductible, you usually pay the full discounted cost up to the deductible amount for drugs listed in Tiers 3, 4 and 5 of your drug list (formulary). (Drugs in Tiers 1 and 2 rarely have a deductible because they generally cost less. Your copayment for these drugs will be the same whether you have met the deductible or not.)

Many people fall into this phase.

Once you reach the deductible amount, you pay a copayment or coinsurance in the initial coverage phase.

Initial coverage phase

Up to $4,660

During this phase, you pay a copayment or coinsurance (your share of the cost) for the discounted price of each prescription you fill. This continues until your total drug costs (what you and your plan pay) reach $4,660.

Most people will remain in this phase.

Once the initial coverage limit (ICL) $4,660 is reached, you enter the coverage gap or “donut hole.”

Coverage gap or “donut hole” phase

Up to $7,400

During this phase, your discount is less. That’s because you’ll receive a minimum level of coverage on brand-name and generic drugs until your yearly out-of-pocket costs reach $7,400.

Some people will move into this phase.

Once your yearly out-of-pocket costs reach $7,400, you move to the catastrophic coverage phase.

Catastrophic coverage phase

Through the end of the year

In this phase, most members will pay only a small copayment or coinsurance amount for each prescription.

Fewer people reach this phase.

Understanding Medicare drug coverage phases

Deductible phase

During this phase, if your plan has a deductible, you usually pay the full discounted cost up to the deductible amount for drugs listed in Tiers 3, 4 and 5 of your drug list (formulary). (Drugs in Tiers 1 and 2 rarely have a deductible because they generally cost less. Your copayment for these drugs will be the same whether you have met the deductible or not.)

Many people fall into this phase.

Once you reach the deductible amount, you pay a copayment or coinsurance in the initial coverage phase.

Initial coverage phase

Up to $4,660

During this phase, you pay a copayment or coinsurance (your share of the cost) for the discounted price of each prescription you fill. This continues until your total drug costs (what you and your plan pay) reach $4,660.

Most people will remain in this phase.

Once the initial coverage limit (ICL) $4,660 is reached, you enter the coverage gap or “donut hole.”

Coverage gap or “donut hole” phase

Up to $7,400

During this phase, your discount is less. That’s because you’ll receive a minimum level of coverage on brand-name and generic drugs until your yearly out-of-pocket costs reach $7,400.

Some people will move into this phase.

Once your yearly out-of-pocket costs reach $7,400, you move to the catastrophic coverage phase.

Catastrophic coverage phase

Through the end of the year

In this phase, most members will pay only a small copayment or coinsurance amount for each prescription.

Fewer people reach this phase.

How much will my prescription drugs cost?

Several factors determine how much you will pay for your prescriptions.

- The plan you choose. Each plan sets its own cost-sharing by tier. Check with your plan about incentives, such as discounted pricing on 90- or 100-day supplies.

- Whether your pharmacy is inside your plan’s network. Generally, you need to use a pharmacy in your plan’s network for the medication to be covered. Some plans have preferred pharmacies where you could save even more.

- Whether the drug you take is on the covered drug list (formulary). Generally, plans will only cover medications if the drug is on their covered drug list (formulary). Medicare drug plans have negotiated to get lower prices for the drugs on their drug lists, so using those drugs will generally save you money. Medicare drug plans have negotiated to get lower prices for the drugs on their drug lists, so using those drugs will generally save you money.

- What tier your medication is on. Plans place their drugs on different tiers which determine costs. Generally, the lower the tier, the less you pay.

- Whether your plan has a deductible. With a deductible, you pay for the full cost of your medication until you’ve met the deductible amount.

- Whether you qualify for extra subsidies. There are programs available to help people with limited incomes pay prescription drug costs. Learn how you may be able to qualify to get help.

Your payments may vary throughout the year, depending on how much you have already spent on prescription drugs. Your cost-sharing will depend upon the benefit phase you have reached in your coverage. Drugs filled in a non-retail setting, such as long-term care or specialty mail, may cost more than the price listed on Medicare Plan Finder. Members can call the number on their ID card to obtain non-retail pricing.

What is the "donut hole"?

Medicare prescription drug plans have a phase called the coverage gap or “donut hole.” When you reach this phase your cost-share may change based upon the type of drug(s) you are taking.

What is the “donut hole”?

The “donut hole” refers to a gap in coverage, during which you may have to pay more for your prescription drugs. Some members may have supplemental coverage to help lower prescription drug costs. Here’s a look at how the “donut hole” works:

Once you and your drug plan spend $4,660*, you enter the donut hole, or coverage gap.

In this phase, you may pay:

- 25% of the total cost of brand-name and generic drugs or

- Your plan’s cost share if it has extra coverage through the coverage gap (check your plan Evidence of Coverage (EOC)

Once your out-of-pocket drug costs reach $7,400, you will leave the coverage gap.

*All dollar amounts reflect 2023 Medicare policies.

What is the “donut hole”?

The “donut hole” refers to a gap in coverage, during which you may have to pay more for your prescription drugs. Some members may have supplemental coverage to help lower prescription drug costs. Here’s a look at how the “donut hole” works:

Once you and your drug plan spend $4,660*, you enter the donut hole, or coverage gap.

In this phase, you may pay:

- 25% of the total cost of brand-name and generic drugs or

- Your plan’s cost share if it has extra coverage through the coverage gap (check your plan Evidence of Coverage (EOC)

Once your out-of-pocket drug costs reach $7,400, you will leave the coverage gap.

*All dollar amounts reflect 2023 Medicare policies.

Here’s an example of how it works:

Are there special rules I need to consider?

Some prescription drugs require that you adhere to special rules before your insurer will cover them. For example:

- Step therapy: If this is the first time you’re taking a drug, you may be required to start with a more cost-efficient version before you can move onto a more expensive medication.

- Prior authorization: Your doctor will need to get approval before the plan will pay for a drug.

- Quantity limits: Certain drugs, such as opioids, will have limits on the number of doses and/or refills that your insurer will cover.

Your plan's drug list (formulary) will tell you which drugs require step therapy, prior authorization and quantity limits. If your medication falls into any of these categories, you may need to take action before the plan will cover the drug. Check with your doctor about your options.

How can I maximize my prescription drug benefits?

If you want to get the most out of your prescription drug benefits, check with your plan to see what extras it offers.

- Use in-network pharmacies. Find out which pharmacies are in your plan's network and if using a preferred pharmacy can save you money.

- Use preferred pharmacies. Many plans offer preferred pharmacies where members typically save even more.

- Order 90- or 100-day supplies. Some plans will offer a lower cost-share on 90- or 100-day supply of medicine. Even if the price is the same, it’ll mean fewer trips to the pharmacy and less chance you’ll miss a refill.

- Opt for delivery. Your plan may offer a delivery option for prescription drugs. Check to see if there’s a lower cost when you order medication through the mail. For example, some Aetna Medicare plans offer lower costs on mail-order prescriptions.

1Centers for Disease Control and Prevention. Table 39. Prescription drug use in the past 30 days, by sex, race and Hispanic origin, and age: United States, selected years 1988–1994 through 2015–2018. 2019. Available at: https://www.cdc.gov/nchs/data/hus/2019/039-508.pdf. Accessed May 10, 2022.

2Centers for Medicare & Medicaid Services. Medicare Part D Enrollment. August 24, 2022. Updated August 31, 2022. Available at: https://data.cms.gov/summary-statistics-on-beneficiary-enrollment/medicare-and-medicaid-reports/cms-program-statistics-medicare-part-d-enrollment. Accessed May 10, 2022.

About the author

Christina Joseph Robinson is a veteran editor and writer from New Jersey who still loves to read the old-fashioned newspaper. She’s raising two fruit-and-veggie loving daughters to balance all the treats Grandma sends their way. Christina’s health goal is to resume her workout routine after being sidelined by injuries.

Research your plan options thoroughly based on your prescription drug needs, costs and convenience. You don’t want to be saddled with unnecessary drug expenses, so finding the right plan for you at the right price means one less thing you’ll have to worry about.