The information you will be accessing is provided by another organization or vendor. If you do not intend to leave our site, close this message.

Do I qualify for financial assistance with Medicare?

By Mark Pabst

By Mark Pabst

When it comes to Medicare, you’ve earned each and every benefit. But it’s important to recognize early on your Medicare journey that the program is not without costs. Some of these are up front, like the monthly premium payments you make to maintain your Medicare coverage. Others are associated with your share of medical services, like the payments you make at the doctor’s office to cover your portion of the care you received, or the percentage of the cost of a hospital stay you are expected to pay.

These payments can add up, and not everyone is able to afford them. But there’s good news: you may be able to qualify for help paying for your Medicare costs. Here are some available options.

Help paying for Medicare premiums

Medicare Savings Programs (MSPs) are programs run by state governments. They may pay for Medicare Part A and/or Part B premiums, deductibles, copayments and coinsurance associated with Medicare for people with limited income and assets.

To learn more about the costs of Medicare, read the most frequently misunderstood Medicare terms.

Income is the amount of money you earn during the year.

Assets are any money you have in the bank, and the value of certain investments (i.e., stocks, bonds and real estate). However, the house you live in and up to one car you own are not counted as assets when it comes to qualifying for a Medicare Savings Program.

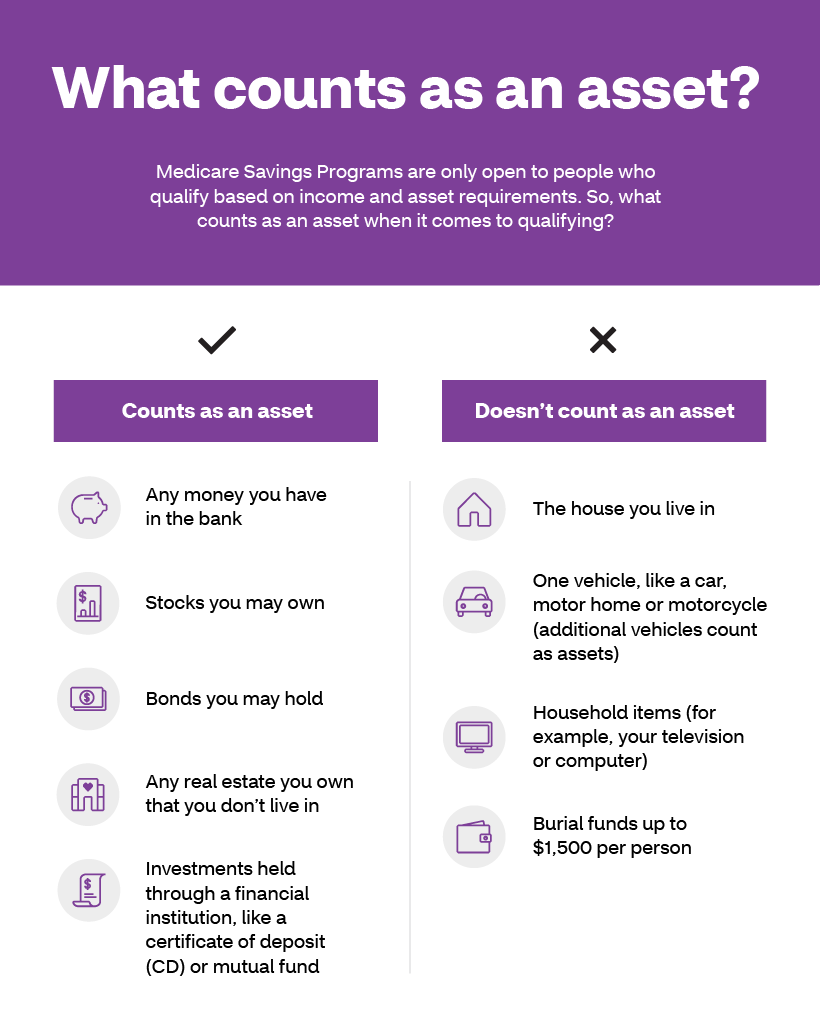

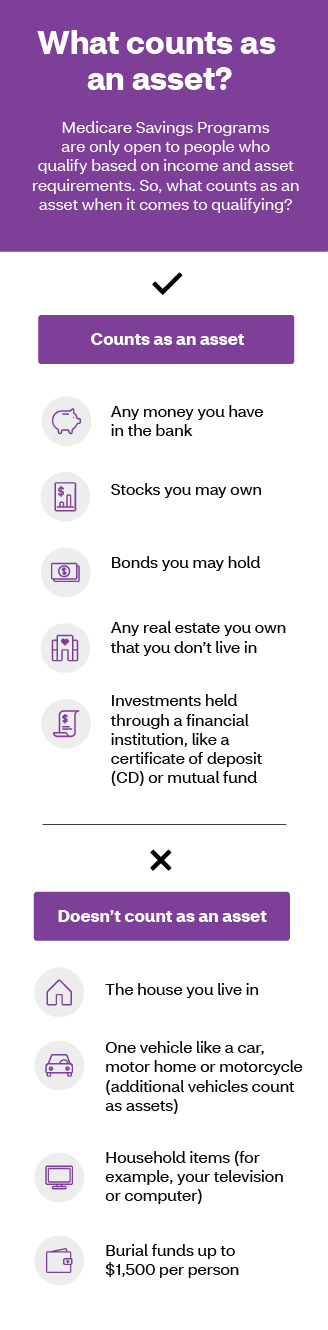

What counts as an asset?

Medicare Savings Programs are only open to people who qualify based on income and asset requirements. So, what counts as an asset when it comes to qualifying?

Counts as an asset

- Any money you have in the bank

- Stocks you may own

- Bonds you may hold

- Any real estate you own that you don’t live in

- Investments held through a financial institution, like a certificate of deposit (CD) or mutual fund

Doesn’t count as an asset

- The house you live in

- One vehicle like a car, motor home or motorcycle (additional vehicles count as assets)

- Household items (for example, your television or computer)

- Burial funds up to $1,500 per person

There are four types of Medicare Savings Programs designed to help with paying costs for Original Medicare or Medicare Part B. They are distinguished by their income limits and what costs they help pay for. The programs include:

- Qualified Medicare Beneficiary Program (QMB)

- This program helps to pay Part A and Part B premiums and copayments. It also helps to pay deductibles and coinsurance for both Part A and Part B.

- A single person can qualify for the program in 2023 with an income up to $1,235 per month.

- A couple can qualify with a combined income of $1,663 per month.

- The asset limits are $9,090 for an individual and $13,630 for a couple.

- Specified Low-Income Medicare Beneficiary Program (SLMB)

- This program helps to pay premiums for Part B.

- A single person can qualify in 2023 with an income up to $1,478 per month.

- A couple can qualify with a combined income of $1,992 per month.

- The asset limits are $9,090 for an individual and $13,630 for a couple.

- Qualified Individual Program (QI)

- This program helps to pay premiums for Part B, but does not cover as large a percentage of the premium as the Specified Low-Income Medicare Beneficiary Program.

- In 2023 a single person can qualify with an income up to $1,660 per month.

- A couple can qualify with a combined income of $2,239 per month.

- The asset limits are $9,090 for an individual and $13,630 for a couple.

- Qualified Disabled and Working Individuals (QDWI) Program

- This program helps to pay premiums for Part A. You may qualify if you have a disability, you’re working, and you lose your Social Security disability and premium-free Part A because you returned to work.

- In 2023 a single person can qualify with an income up to $4,945 per month.

- A couple can qualify with a combined income of $6,659 per month.

- The asset limits are $4,000 for an individual and $6,000 for a couple.

It is important to note that income limits to qualify for these programs are slightly different in Alaska and Hawaii. To learn more about the income limits in those states, see details on the Social Security Administration website.

It’s important to recognize early in your Medicare journey that the program is not without costs. But if you need help paying for Medicare, there are options available.

Help from Medicaid

Medicaid is a health insurance program operated by each state that is designed to provide coverage for low-income and low-asset individuals. Each state sets its own limits on income, assets and the type of benefits they include in their Medicaid program. It’s possible to be eligible for both Medicare and Medicaid. In fact, about 16 percent of people who receive Medicare benefits also receive help paying for Original Medicare – and most of these people also receive Medicaid benefits.1 If you receive Medicare benefits and meet your state’s Medicaid eligibility requirements – income and asset requirements, plus citizenship and residency requirements for full Medicaid benefits – you can be full benefit dual eligible.

If you are a full benefit dual eligible, you can receive benefits included in both Medicaid and Medicare coverage. Here are some examples of what’s covered under Medicaid:

- Some types of care you get at your home, like nursing that focuses on helping a person get in and out of bed or get dressed

- Care delivered in a nursing home

- Some prescription drugs not covered by Medicare Part D plans

Paying for a prescription drug plan

If you qualify for the QMB, SLMB or QI Medicare Savings Programs, then you also automatically qualify for a program called Extra Help designed to help with paying for your prescription drugs. Prescription drug coverage is provided through Medicare Part D, which is why Extra Help is also known as the Part D Low-Income Subsidy. Part D coverage generally comes with a premium, a deductible and a copayment or coinsurance. Learn more about Medicare Part D here.

But you don’t have to be in a Medicare Savings Program to receive help paying for your prescriptions under Extra Help. If your annual income as an individual is up to $1,822.50 per month or $2,465 as a couple in 2023, you may be eligible. Asset limits in 2023 are up to $16,600 for an individual or $33,240 for a couple.

Depending on which Medicare Part D plan you choose, the program can reduce or eliminate your plan’s premium and deductible, and also lower the cost you pay for the prescription drugs covered under your plan.

Finding out if you qualify

With so many different programs providing assistance for so many different types of costs, it’s easy to get confused. Fortunately, there is help available to find out if you qualify for financial assistance for Medicare.

A good place to start is with BenefitsCheckup.org, a free online tool from the National Council on Aging that connects people with benefits they may qualify for. Insurance brokers and state-area offices on aging are also excellent resources.

Don’t be afraid to reach out for help in finding out if you qualify for assistance paying for your Medicare coverage. After all, you’ve earned it.

1Kaiser Family Foundation. A Snapshot of Sources of Coverage Among Medicare Beneficiaries in 2018. March 23, 2021. Available at: https://www.kff.org/medicare/issue-brief/a-snapshot-of-sources-of-coverage-among-medicare-beneficiaries-in-2018/. Accessed May 2, 2022.

About the author

Mark Pabst has worked as a writer and researcher in the health care field for almost two decades. When not writing about health he tries to stay healthy through activities like hiking, climbing and paddling in the far flung corners of his native state of California. However, despite his best efforts he still has a few unhealthy habits he can’t shake, most notably a weakness for jelly donuts.

Y0001_NR_34024_2023_C

72.00.337.1