The information you will be accessing is provided by another organization or vendor. If you do not intend to leave our site, close this message.

Unpacking Original Medicare: What Parts A and B cover – and when to consider a Medicare Supplement plan

By Mark Pabst

By Mark Pabst

Medicare Supplement Additional Coverage

How can you supplement your original Medicare coverage? Medicare supplement plans enhance original Medicare by offering additional coverage.

Let's unpack the benefits. First, we need to look at original Medicare, also known as Medicare Parts A and B. Medicare Part A helps cover costs associated with hospital care, and Medicare Part B helps cover costs for things like doctor visits and outpatient procedures. Original Medicare only covers a portion of costs associated with hospital stays and doctor visits. In fact, sometimes it doesn't cover them at all.

So, why consider additional coverage? Original Medicare may not provide all of the benefits you need. That's where a Medicare supplement plan can help. For example, if you travel, a Medicare supplement plan could pay for care abroad. Under original Medicare, you're still responsible for a percentage of your medical costs. But Medicare supplement plans can help pay for the part of your bills that aren't covered.

Finding the coverage that fits you is a key part of navigating Medicare. Keep in mind, Medicare supplement plans might not include everything, but they give you more options to find the coverage that best matches your goals.

Got more questions? Learn more at AetnaMedicare.com.

When Medicare was originally signed into law in 1965 by President Lyndon B. Johnson, it had two complementary parts, A and B. These parts are known as Original Medicare. Part A covered procedures associated with hospital care, and Part B covered outpatient care. However, it didn’t take long for people to begin looking for ways to supplement the coverage.

Why?

Parts A and Part B provide widely accepted inpatient and outpatient coverage. However, people also wanted help paying for some of the costs associated with their new Medicare coverage. For example, the portion of doctor fees they were still responsible for paying under the new program.

The government, recognizing the popularity of the plans, moved to formalize and regulate these forms of private supplemental coverage. Today, Medicare Supplement plans are a popular choice for people looking for help with some of the out-of-pocket costs associated with Original Medicare. And they’re also popular with those who’d like some extra benefits.

What is Original Medicare?

Many people choose to add a Medicare Supplement plan to their Original Medicare coverage. To understand why, let’s take a look at Original Medicare. Medicare Part A covers medical services that are often associated with a stay in the hospital. It also covers some types of care that often occur following a hospital stay. This can include things like:

- Inpatient care in a hospital

- Inpatient care in a skilled nursing facility

- Hospice care

- Home health care

Medicare Part B covers the type of care that often takes place outside a hospital or on an outpatient basis. This includes things like:

- Medically necessary doctor services

- Preventive care services, like health screenings, flu vaccines and annual wellness visits to your doctor

- Durable medical equipment, like wheelchairs or portable oxygen tanks you may need to buy to support your health

The cost of Original Medicare

When it became law, Original Medicare provided an unprecedented level of care for Americans 65 and older. But there are costs associated with the coverage. For example, with Part A, you are responsible for paying a $1,340 deductible before your benefits kick in. After that, if you have a problem that requires hospitalization for up to 60 days, Part A covers your needs. If your stay is more than 60 days, you’ll have to cover part of the price of your stay. And hospital costs can add up quickly, even with Part A chipping in.

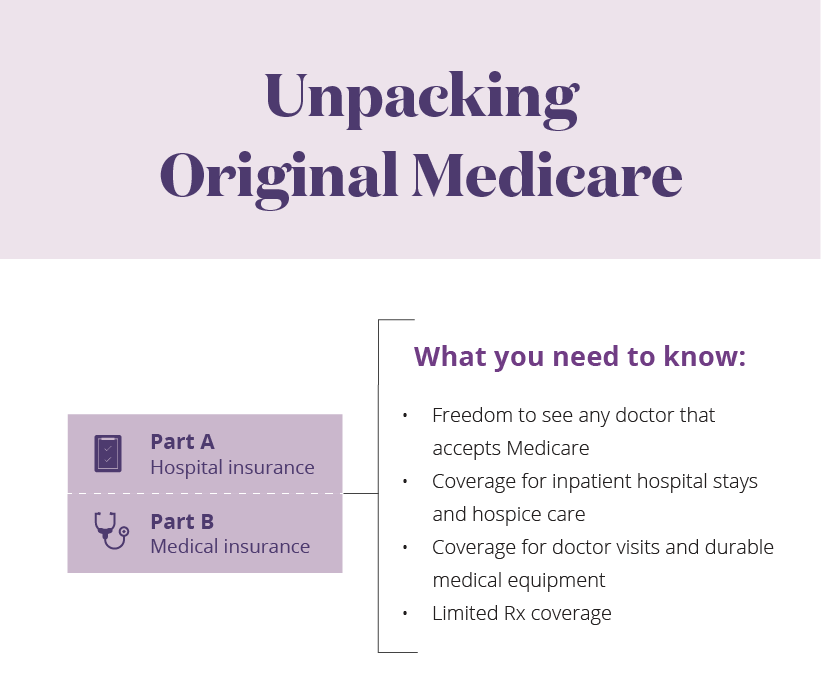

Unpacking Original Medicare Infographic

Part A

Hospital insurance

Part B

Medical insurance

What you need to know:

- Freedom to see any doctor that accepts Medicare

- Coverage for inpatient hospital stays and hospice care

- Coverage for doctor visits and durable medical equipment

- Limited Rx coverage

Some extra help with costs

To protect people from the costs, the government worked with private insurers to come up with a set of plans that are designed to help with some of the costs associated with Original Medicare. By paying a monthly premium for a Medicare Supplement plan, you can get financial help with:

- Paying for your Part A deductible and the share of inpatient care costs not covered by Part A

- Paying for your doctor bills for Part B services

- Paying the costs of hospice care not handled by Original Medicare

These benefits mean that if you have a Medicare Supplement plan, you can:

- Pay a predictable up-front premium for your coverage

- Reduce the amount that you have to pay if you have a long inpatient hospital stay or repeat visits to a specialist.

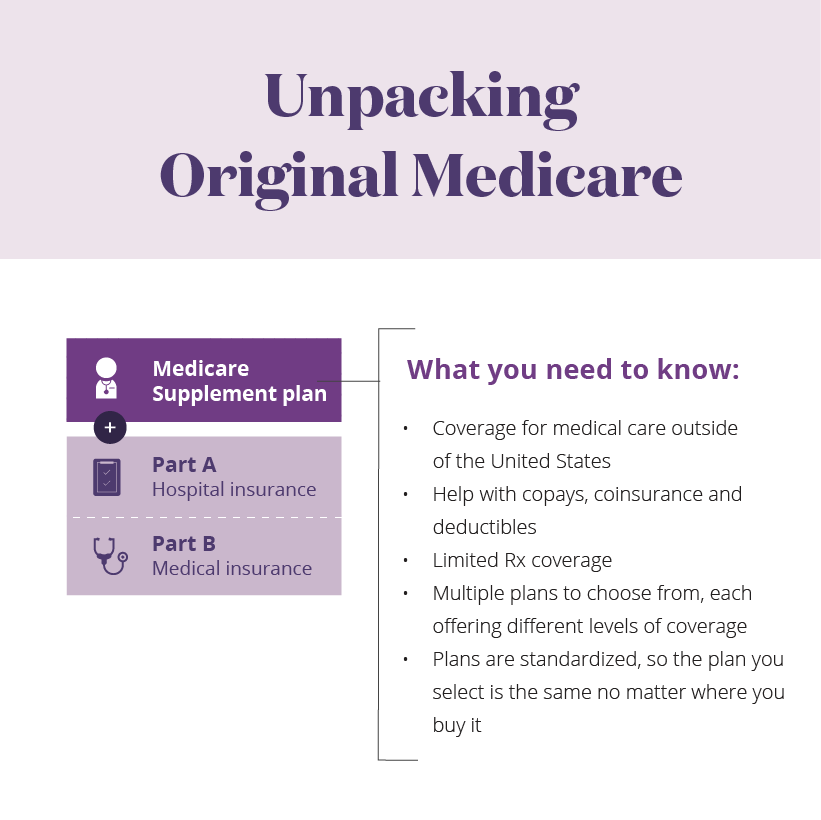

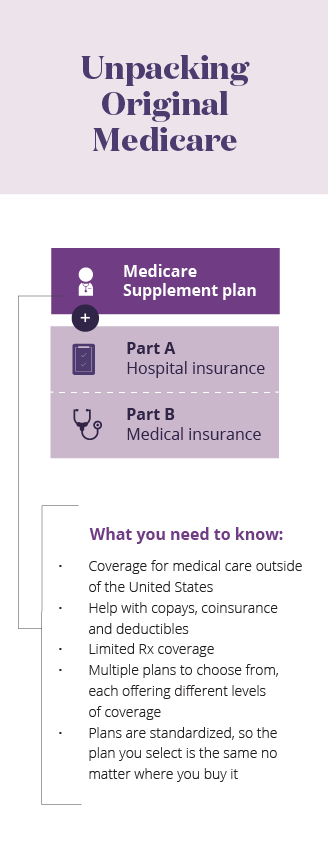

Unpacking Original Medicare

Part A

Hospital insurance

Part B

Medical insurance

+

Medicare Supplement plan

What you need to know about Medicare Supplement Plans:

- Coverage for medical care outside of the United States

- Help with copays, coinsurance and deductibles

- Limited Rx coverage

- Multiple plans to choose from, each offering different levels of coverage

- Plans are standardized, so the plan you select is the same no matter where you buy it

There are several Medicare Supplement plans offered by private insurance companies, each offering slightly different coverage with slightly different costs. Each Medicare Supplement plan is identified by a letter of the alphabet. For example, Medicare Supplement plan G offers emergency medical coverage abroad, while Medicare Supplement plan K has a lower cost than plan G, but does not include coverage abroad. Make sure not to confuse these plans for the different parts of Medicare, which are also identified by letters. By law, Medicare Supplement plans are regulated by Medicare. They vary only in cost and coverage.

Medicare Supplement plans even have a few welcome additions. For example, some plans will cover your health care while traveling abroad. If you have the appropriate Medicare Supplement plan and need to see a doctor in Rome, Paris or even Ouagadougou, your plan may help pay the costs.

Finding the coverage that fits you best is a key part of navigating Medicare.

Looking for help with more than costs?

Original Medicare doesn’t cover things like prescription drugs, dental services, vision and hearing. To get prescription drug coverage, you need to purchase a Medicare Part D plan. Part D plans are sold by private insurance companies. They’re specifically designed to help pay the cost of prescription medications. Learn more about Medicare Part D here. An additional way to get drug coverage is to purchase another part of Medicare, called a Medicare Advantage plan. Medicare Advantage plans are sold by private insurance companies and are also known as Medicare Part C.

Medicare Advantage plans often include additional coverage, like dental, vision and hearing. There are some important similarities and differences between Medicare Supplement plans and Medicare Advantage plans.

While both are provided by private insurance companies, there are some key differences between Medicare Supplement plans and Medicare Advantage plans:

- Medicare Advantage plans often provide prescription drug coverage. Medicare Supplement plans don’t.

- Medicare Supplement plans work together with Parts A and B. Medicare Advantage plans include all the benefits of Part A and B but you work with a private company, not the federal government.

That means you can’t be covered by a Medicare Advantage plan and a Medicare Supplement plan at the same time. So, if you choose a Medicare Advantage plan, you won't be able to purchase an additional Medicare Supplement plan. But you’ll also usually get benefits with a Medicare Advantage plan that aren’t included in either Original Medicare or Medicare Supplement coverage.

Making the choice

Of course, deciding which Medicare coverage is right for you depends on many factors. Medicare Supplement plans offer a unique combination of benefits. But only you can decide if they’re the best fit for your lifestyle.

About the author

Mark Pabst has worked as a writer and researcher in the health care field for almost two decades. When not writing about health he tries to stay healthy through activities like hiking, climbing and paddling in the far flung corners of his native state of California. However, despite his best efforts he still has a few unhealthy habits he can’t shake, most notably a weakness for jelly donuts.