The information you will be accessing is provided by another organization or vendor. If you do not intend to leave our site, close this message.

5 things to know about Medicare when you’re working past 65

By Bonnie Gibbs Vengrow

By Bonnie Gibbs Vengrow

If you or your spouse are planning to work after turning 65, you’re probably wondering how working past 65 and Medicare go together. One of the most important first questions to ask is if your employer requires you to take Medicare Parts A and B when you turn 65.* Your human resources representative can help you figure that out.

But there are other factors to think about that can help you minimize expenses and maximize coverage. To help guide you through your options, here are some other key questions to consider.

Do you get your health insurance through a job with a small business?

If you or your spouse are working past 65, the size of the company that provides your insurance matters.

Let’s say your spouse has been working for a small business for the last 10 years and both of you receive your health coverage through their employer. Even if your spouse isn’t considering retirement, the size of their employer is an important factor for you when you need to enroll in Medicare.

That’s because companies with 19 or fewer employees can require you to enroll in Medicare Parts A and B when you turn 65 to continue receiving coverage through the employer.* Note that if you don’t sign up for Medicare, you could have a gap in your health coverage.

Companies with 20 or more employees are required to continue offering health insurance to current workers and their spouses who are 65 or older. If you’re insured under a plan from a company of that size, you have the option to enroll in Medicare and decline your group plan, but the employer can’t force this decision.

What if you get a payment from your employer to buy your own health insurance?

Now, let’s say the company your spouse works for gives them a certain amount to help pay for the health plan that covers you both. That can also affect when you may decide to enroll in Medicare.

If you purchase private health insurance through an employer payment, it’s a smart idea to do some research. In some cases, private insurers may reduce the amount they pay for services once you’re eligible for Medicare. Medicare may also not work with your insurance, and once you sign up for Parts A and B, Medicare will pay your medical bills first, before your insurance. Bottom line: Talk to your health insurance company about whether you need to sign up for Medicare when you turn 65.

Are you or your spouse still working but don’t have any type of health insurance?

If you don’t currently have coverage, you should sign up for Medicare Parts A and B when you’re first eligible. Doing so can help shield you from higher-than-expected medical costs. Signing up for Medicare on time is also important. You may have to pay late enrollment penalties if you decide to postpone your enrollment.

Need help paying for Medicare costs? There are financial assistance programs available to those who qualify.

Read more about those programs in the article “Do I qualify for financial assistance with Medicare?”

Do you have COBRA coverage but haven’t signed up for Medicare yet?

If you're enrolled in COBRA, your plan may only pay for a small part of your medical costs once you become eligible for Medicare. To help you avoid unexpected bills, late enrollment penalties and gaps in coverage, sign up for Medicare Parts A and B when you turn 65.* Keep in mind that once you have Medicare, your COBRA will probably end. Read “Leaving your job after 65? Taking these 3 actions in time can prevent gaps in your coverage” to learn how COBRA works with Medicare.

Did you start receiving your Social Security or railroad retirement benefits before you turned 65?

Let’s say you chose to start receiving your Social Security benefits at age 62. That decision affects how and when you enroll in Medicare.

Why? Because if you’re already receiving Social Security or railroad benefits, you’ll be automatically enrolled in Medicare Parts A and B when you turn 65. You can choose to opt out of Part B, but you’ll likely be penalized and have to pay a higher premium if you decide to enroll later.

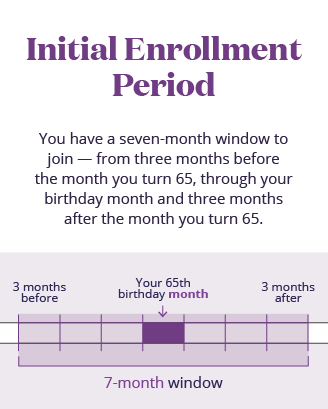

If you aren’t collecting benefits when you turn 65, you should plan to sign up for Medicare on your own. You can enroll during your initial enrollment period (IEP). This is a seven-month window that includes the three months before, the month of and the three months after you turn 65. If you don’t sign up for Medicare during your IEP, you can do so during the general enrollment period, which happens each year from January 1 to March 31. However, you may have to pay a lifetime late enrollment penalty.

Initial Enrollment Period

You have a seven-month window to join – from three months before the month you turn 65, through your birthday month and three months after the month you turn 65.

This includes

- 3 months before

- Your 65th birthday month

- 3 months after

- 7-month window

Initial Enrollment Period

You have a seven-month window to join – from three months before the month you turn 65, through your birthday month and three months after the month you turn 65.

This includes

- 3 months before

- Your 65th birthday month

- 3 months after

- 7-month window

If you’re working and can delay taking your Medicare benefits, your next chance to enroll in Medicare is during a special enrollment period (SEP). This two-month period begins the month you leave your job and ends two months later.

If you want to join a Medicare Advantage (MA) plan or stand-alone prescription drug plan, you’ll need to sign up within two months after your employer coverage ends.

Not sure when you can sign up for Medicare? Read “Unpacking Medicare: What you need to know about Medicare enrollment periods (and when you can change your plan).”

Turning 65 often goes hand in hand with enrolling in Medicare. But if you’re working past 65 and are thinking about Medicare, you have a few additional things to consider. If you (or your spouse) are planning to continue working past the age of 65, it might not make sense to make the switch in coverage just yet. As you consider your options, be sure to speak with your human resources representative and a licensed agent so you understand when you’ll need to sign up for Medicare, how your costs could change and how to find coverage that’s right for your health needs and budget.

To talk with a licensed agent about your Medicare options, call:

1-833-206-7237 ${tty}

${hours}

*If you were born on the first day of the month, you will be eligible on the first day of the month prior to your birth month. (For example, if you were born on July 1, you will be eligible on June 1.)

Plan features and availability may vary by service area.