The information you will be accessing is provided by another organization or vendor. If you do not intend to leave our site, close this message.

How does Social Security affect your Medicare enrollment? It depends on when you sign up.

By Mark Pabst

By Mark Pabst

Medicare and Social Security are both programs administered by the federal government. Each is designed to provide you with important benefits as you age.

Social Security provides a monthly cash benefit. Medicare provides health coverage that can reduce the out-of-pocket costs associated with health-related expenses.

While Social Security and Medicare are distinct programs that each provide unique benefits, when you choose to begin taking your Social Security benefits can affect when you enroll in Medicare.

So, if you’re thinking about delaying your enrollment in Medicare or taking your Social Security benefits later than age 65, read on to find out how the timing of your Social Security benefits can influence when you enroll in Medicare.

Timing Social Security benefits: You have options

If you or your spouse worked at a job that paid Social Security tax into the Social Security trust fund for 10 years or more, you are generally able to receive monthly benefits. But the rules can be complex. So, if you’re not sure if you’re eligible, check with the Social Security Administration (SSA).

The amount of your monthly benefit is based on several factors. Your benefit is the average of your 35 highest-income years. So the longer you work and the more you earn will mean a bigger Social Security check.

Delaying when you start taking your benefits can also increase the size of your Social Security check. You can start getting a monthly benefit as early as age 62. But if you wait, you’ll usually get a bigger payment each month. For example, your Social Security benefits will increase 8% every year up until age 70. After that, there is no additional benefit from waiting.

If you're interested in calculating your potential Social Security benefits at different ages, use the calculator here.

When you take Social Security can affect your Medicare enrollment

If you choose to take your monthly Social Security benefit before you turn 65, you’ll automatically be enrolled in Medicare Parts A and B. Together, Medicare Parts A and B are known as Original Medicare. For most people who sign up for Social Security before age 65, their Original Medicare coverage starts automatically the first day of the month of their 65th birthday.*

If you choose to wait past 65 to take your Social Security benefits, you will need to actively apply for Medicare through the Social Security Administration (SSA) once you’re ready to get Medicare coverage.

Are you over 65 and want to sign up for Original Medicare? Start at the SSA website.

It’s also important to remember that, unlike with Social Security, you do not get any extra Medicare benefits if you wait past the age of 65 to enroll in Medicare. In some cases, you could even pay a penalty.

To learn more about penalties for late enrollment in Medicare, read “How to avoid Medicare late enrollment penalties.”

But that doesn’t mean you have to enroll in Medicare at age 65. In fact, there are several situations where you can delay enrolling in Medicare without paying any penalty if you have certain types of health coverage through your employer.

So, what’s the right move?

What age should you claim Social Security benefits?

The short answer: It depends. If you need your Social Security benefits at 62, then you should claim them. But it’s also important to remember that when you choose to take your benefits can affect your enrollment in Medicare. So be sure to do your research before making a decision.

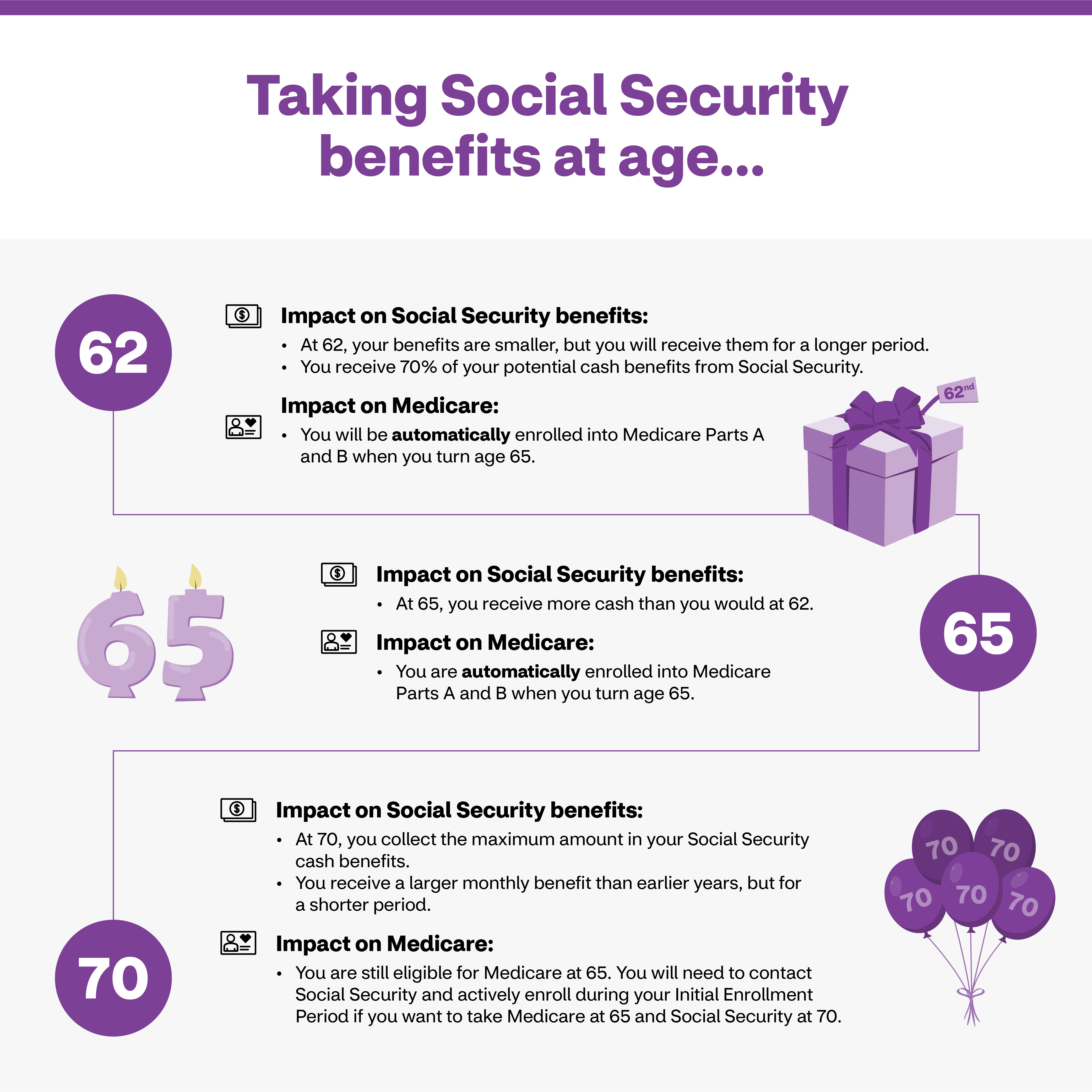

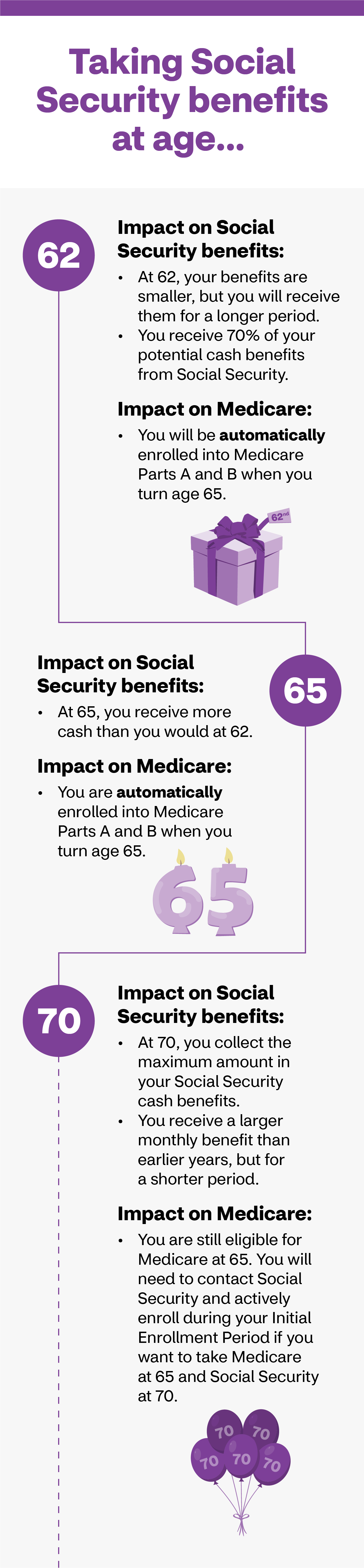

To help you make an informed choice, take a look at our Social Security and Medicare infographic. It outlines the impact of taking Social Security benefits at different ages and how that timing affects your Medicare enrollment.

*If you were born on the first day of the month, you will be eligible on the first day of the month prior to your birth month. (For example, if you were born on July 1, you will be eligible on June 1.)

Taking Social Security benefits at age 62

Impact on Social Security benefits:

- At 62, your benefits are smaller, but you will receive them for a longer period.

- You receive 70% of your potential cash benefits from Social Security.

Impact on Medicare:

- You will be automatically enrolled into Medicare Parts A and B when you turn age 65.

Taking Social Security benefits at age 65

Impact on Social Security benefits:

- At 65, you receive more cash than you would at 62.

Impact on Medicare:

- You are automatically enrolled into Medicare Parts A and B when you turn age 65.

Taking Social Security Benefits at age 70

Impact on Social Security benefits:

- At 70, you collect the maximum amount in your Social Security cash benefits.

- You receive a larger monthly benefit than earlier years, but for a shorter period.

Impact on Medicare:

- You are still eligible for Medicare at 65. You will need to contact Social Security and actively enroll during your Initial Enrollment Period if you want to take Medicare at 65 and Social Security at 70.

Taking Social Security benefits at age 62

Impact on Social Security benefits:

- At 62, your benefits are smaller, but you will receive them for a longer period.

- You receive 70% of your potential cash benefits from Social Security.

Impact on Medicare:

- You will be automatically enrolled into Medicare Parts A and B when you turn age 65.

Taking Social Security benefits at age 65

Impact on Social Security benefits:

- At 65, you receive more cash than you would at 62.

Impact on Medicare:

- You are automatically enrolled into Medicare Parts A and B when you turn age 65.

Taking Social Security Benefits at age 70

Impact on Social Security benefits:

- At 70, you collect the maximum amount in your Social Security cash benefits.

- You receive a larger monthly benefit than earlier years, but for a shorter period.

Impact on Medicare:

- You are still eligible for Medicare at 65. You will need to contact Social Security and actively enroll during your Initial Enrollment Period if you want to take Medicare at 65 and Social Security at 70.