The information you will be accessing is provided by another organization or vendor. If you do not intend to leave our site, close this message.

How to avoid Medicare late enrollment penalties

By Bonnie Vengrow

By Bonnie Vengrow

When it comes to enrolling in Medicare, timing is everything. Generally speaking, unless you have another source of qualifying coverage or you meet the criteria for an exception, you should sign up for Medicare at age 65. Otherwise, you could face late enrollment penalties. These surcharges are tacked on to your monthly premiums and can add up over time.

In this article, we’ll take a closer look at late enrollment penalties for Medicare Part A (hospital insurance), Part B (medical insurance) and Part D (prescription drug coverage) and how you can avoid them. We’ll also discuss when you can enroll in Medicare Advantage plans.

Part A late enrollment penalty

If, like most people, you or your spouse worked and paid Medicare taxes for at least 10 years, you’re automatically eligible for premium-free Medicare Part A. Since you don’t have to sign up for coverage, you don’t need to worry about incurring a late enrollment penalty.

If you or your spouse didn’t work enough hours and don’t qualify for premium-free Part A, you can still purchase it. You can sign up for Part A during your Initial Enrollment Period (IEP), a seven-month window that runs three months before the month you turn 65, your birthday month and three months after the month you turn 65. You will pay a monthly premium for coverage.

The amount you pay depends on how long you or your spouse worked and paid Medicare taxes. Every three months of work counts as one “work credit.” In 2023, you’ll pay a monthly premium of either $278 if you’ve accrued 30-39 work credits or $506 if you’ve accrued less than 30 work credits.

If you don’t sign up for Medicare Part A during your IEP, you’ll pay a late enrollment penalty. The penalty is 10 percent of the cost of your monthly premium. You’ll pay this extra cost every month for twice the number of years you were eligible for Medicare Part A but didn’t sign up.

For example, if you were eligible for Part A one year ago but didn’t sign up, you’ll pay the 10 percent premium penalty every month for two years.

You can delay enrolling in Part A without being penalized if you have creditable coverage. This is health insurance that’s as good as or better than what Medicare covers, such as through your or your spouse’s employer, for example.

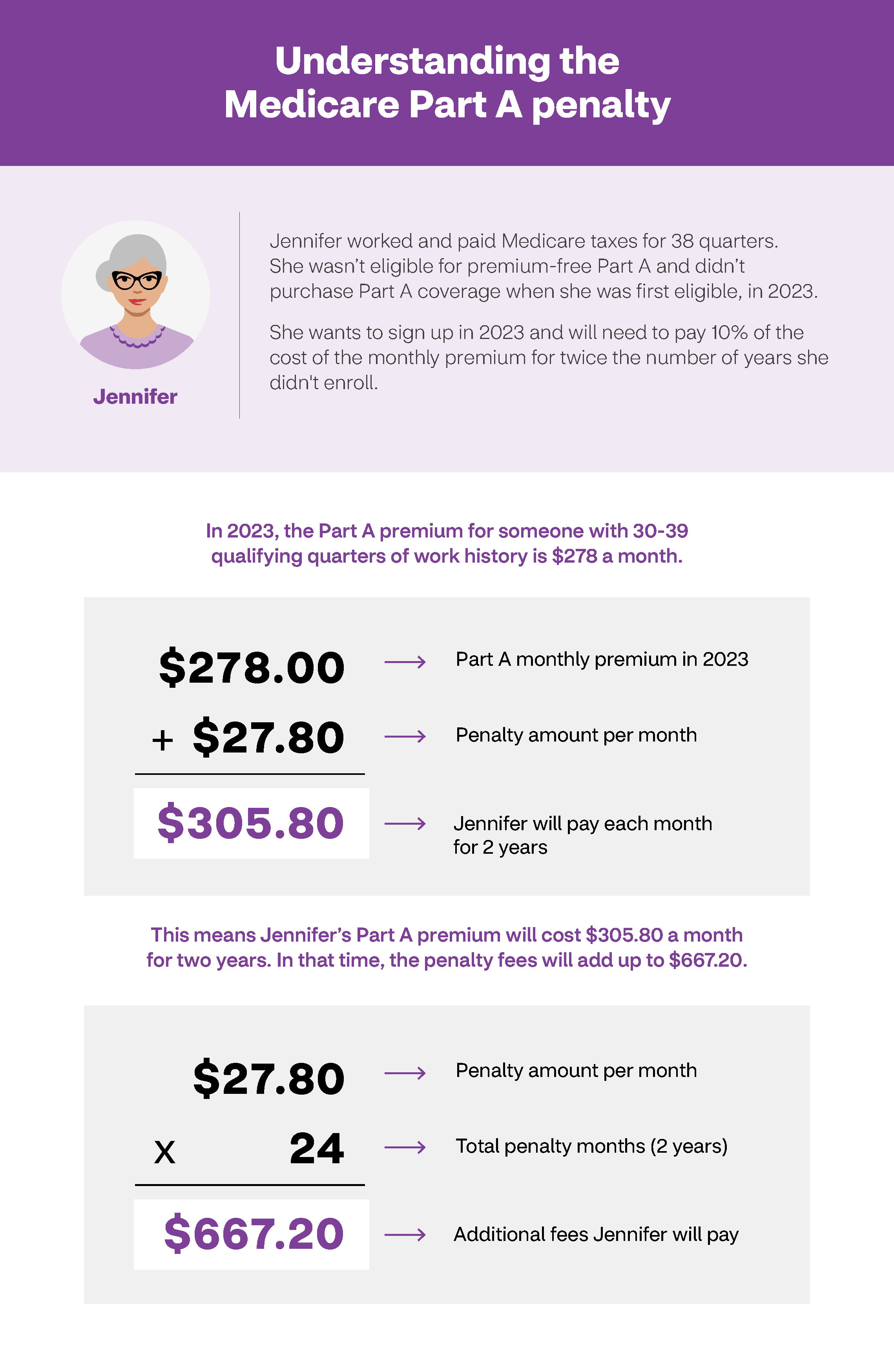

Jennifer worked and paid Medicare taxes for 38 quarters. She wasn’t eligible for premium-free Part A and didn’t purchase Part A coverage when she was first eligible, in 2023.

She wants to sign up in 2023 and will need to pay 10% of the cost of the monthly premium for twice the number of years she didn't enroll.

In 2023, the Part A premium for someone with 30-39 qualifying quarters of work history is $278 a month.

$278.00 Part A monthly premium in 2023

+

$27.80 Penalty amount per month

=

$305.80 Jennifer will pay each month for 2 years

This means Jennifer’s Part A premium will cost $305.80 a month for two years. In that time, the penalty fees will add up to $667.20.

$27.80 Penalty amount per month

x

24 Total penalty months (2 years)

=

$667.20 Additional fees Jennifer will pay

Jennifer worked and paid Medicare taxes for 38 quarters. She wasn’t eligible for premium-free Part A and didn’t purchase Part A coverage when she was first eligible, in 2023.

She wants to sign up in 2023 and will need to pay 10% of the cost of the monthly premium for twice the number of years she didn't enroll.

In 2023, the Part A premium for someone with 30-39 qualifying quarters of work history is $278 a month.

$278.00 Part A monthly premium in 2023

+

$27.80 Penalty amount per month

=

$305.80 Jennifer will pay each month for 2 years

This means Jennifer’s Part A premium will cost $305.80 a month for two years. In that time, the penalty fees will add up to $667.20.

$27.80 Penalty amount per month

x

24 Total penalty months (2 years)

=

$667.20 Additional fees Jennifer will pay

Part B late enrollment penalty

Like Medicare Part A, you can sign up for Medicare Part B during your IEP. However, if you decide not to enroll in Medicare Part B during this time — and you don’t qualify for a Special Enrollment Period — you’ll incur a late enrollment penalty. You may qualify for a Special Enrollment Period if you experience certain life events, such as a move or loss of other health coverage. Your monthly premium will increase by 10 percent for every 12-month period you were eligible for Medicare Part B but didn’t sign up. In most cases, you’ll need to pay this extra cost for as long as you have Part B.

Understanding the Medicare Part B penalty

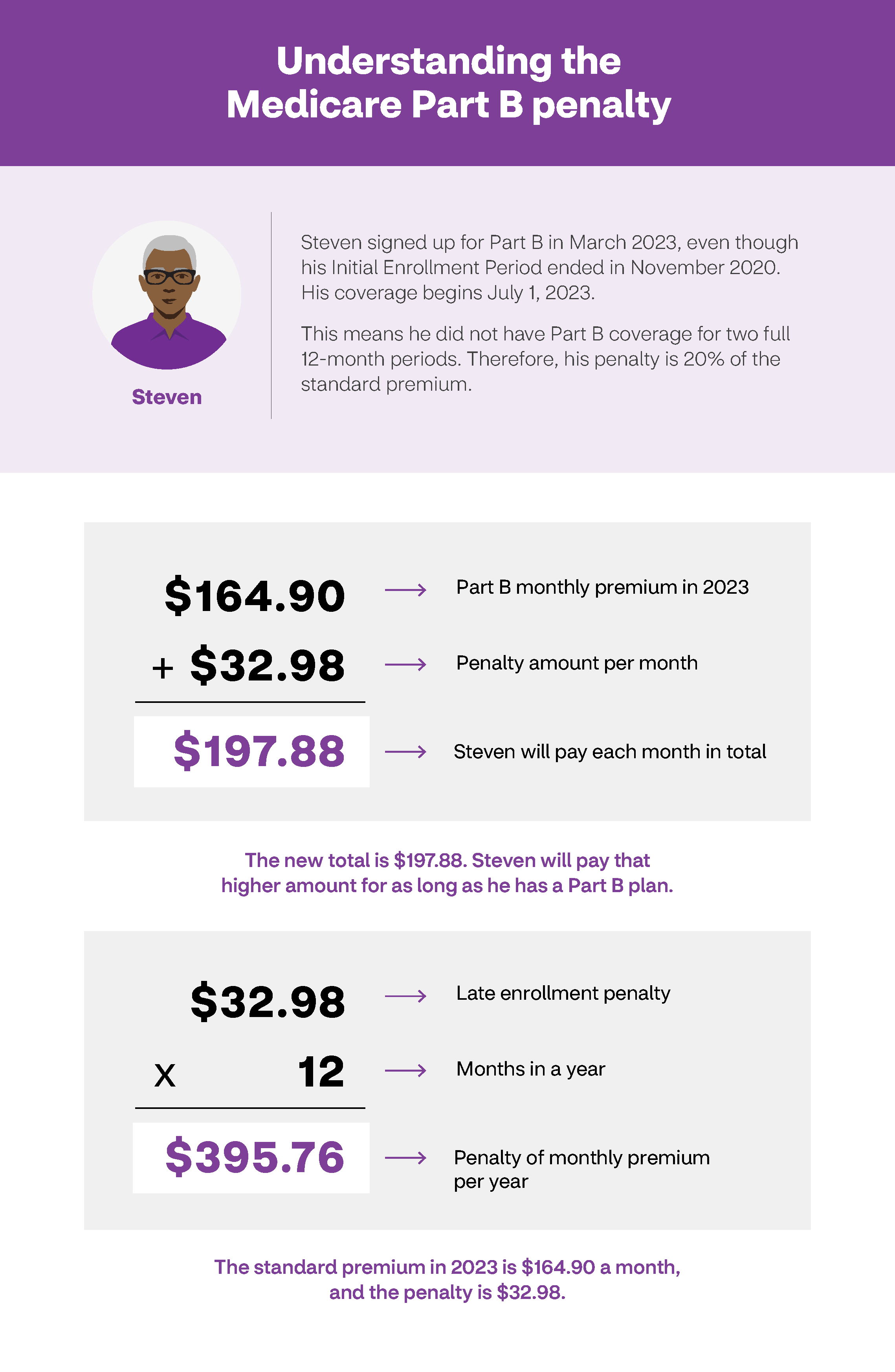

Steven signed up for Part B in March 2023, even though his Initial Enrollment Period ended in November 2020. His coverage begins July 1, 2023.

This means he did not have Part B coverage for two full 12-month periods. Therefore, his penalty is 20% of the standard premium.

$164.90 Part B monthly premium in 2023

x

$32.98 Penalty amount per month

=

$197.88 Steven will pay each month in total

The new total is $197.88. Steven will pay that higher amount for as long as he has a Part B plan.

$32.98 Late enrollment penalty

x

12 Months in a year

=

$395.76 Penalty of monthly premium per year

The standard premium in 2023 is $164.90 a month, and the penalty is $32.98.

Understanding the Medicare Part B penalty

Steven signed up for Part B in March 2023, even though his Initial Enrollment Period ended in November 2020. His coverage begins July 1, 2023.

This means he did not have Part B coverage for two full 12-month periods. Therefore, his penalty is 20% of the standard premium.

$164.90 Part B monthly premium in 2023

x

$32.98 Penalty amount per month

=

$197.88 Steven will pay each month in total

The new total is $197.88. Steven will pay that higher amount for as long as he has a Part B plan.

$32.98 Late enrollment penalty

x

12 Months in a year

=

$395.76 Penalty of monthly premium per year

The standard premium in 2023 is $164.90 a month, and the penalty is $32.98.

Part D late enrollment penalty

You can sign up for a Medicare Part D drug plan during your IEP when you’re also eligible to enroll in Medicare Part A and Part B. You can also enroll during the first three months after your Part A and Part B begin.

After that time, if you go without Part D or other creditable prescription drug coverage for 63 days or more in a row, you’ll pay a late enrollment penalty. Creditable prescription drug coverage pays, on average, as much as or more than a Part D plan.

Medicare calculates the penalty by multiplying 1 percent of the average monthly plan price by the number of months you were without coverage. The fee is added to your monthly premium for as long as you have a Part D plan.

You will not have to pay a late enrollment penalty if you’re eligible for a Special Enrollment Period and sign up then or are eligible for the Extra Help program.

Understanding the Medicare Part D penalty

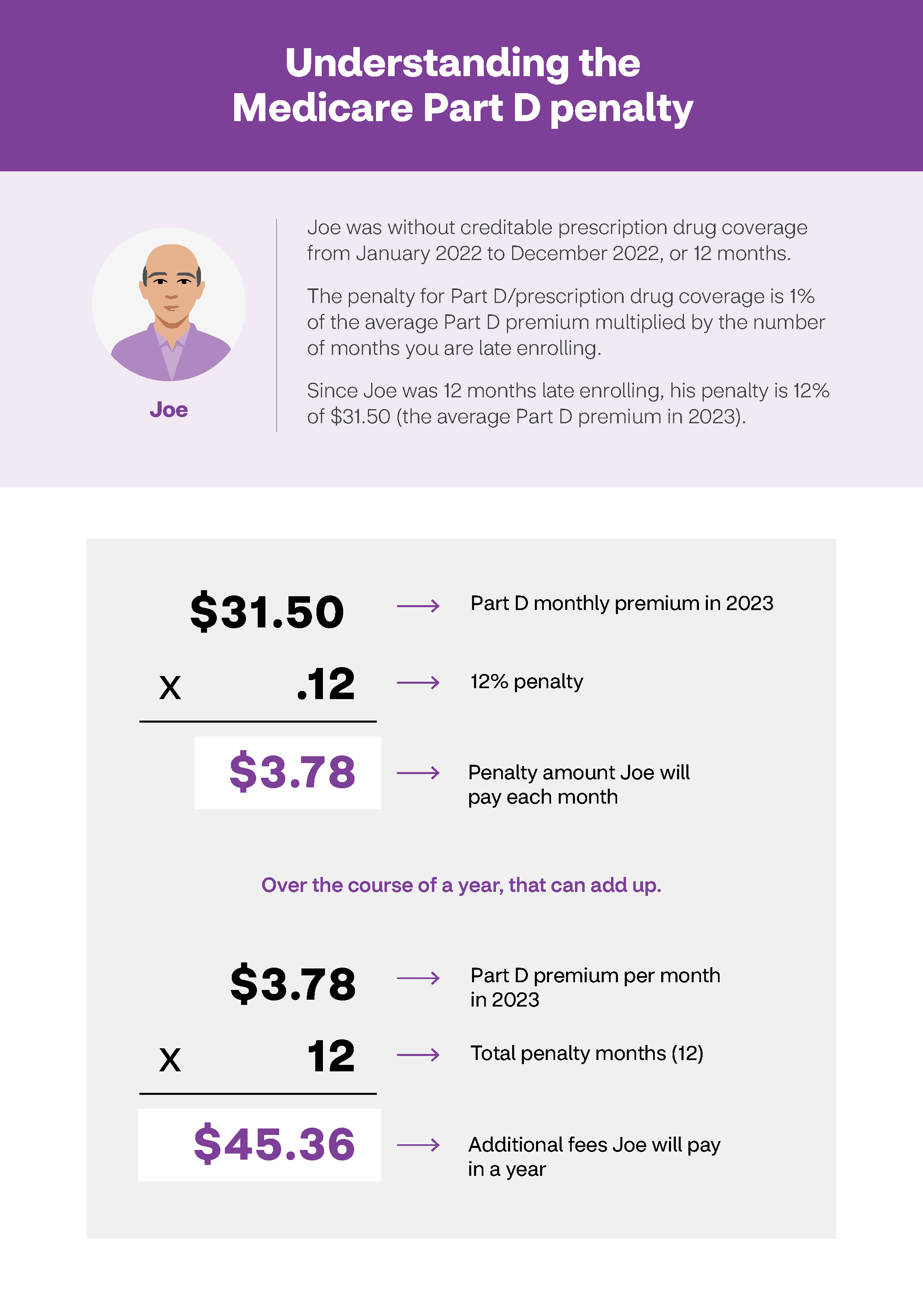

Joe was without creditable prescription drug coverage from January 2022 to December 2022, or 12 months.

The penalty for Part D/prescription drug coverage is 1% of the average Part D premium multiplied by the number of months you are late enrolling.

Since Joe was 12 months late enrolling, his penalty is 12% of $31.50 (the average Part D premium in 2023).

$31.50 Part D monthly premium in 2023

x

.12 12% penalty

=

$3.78 Penalty amount Joe will pay each month

Over the course of a year, that can add up.

$3.78 Part D premium per month in 2023

x

12 Total penalty months 12

=

$45.36 Additional fees Joe will pay in a year

Understanding the Medicare Part D penalty

Joe was without creditable prescription drug coverage from January 2022 to December 2022, or 12 months.

The penalty for Part D/prescription drug coverage is 1% of the average Part D premium multiplied by the number of months you are late enrolling.

Since Joe was 12 months late enrolling, his penalty is 12% of $31.50 (the average Part D premium in 2023).

$31.50 Part D monthly premium in 2023

x

.12 12% penalty

=

$3.78 Penalty amount Joe will pay each month

Over the course of a year, that can add up.

$3.78 Part D premium per month in 2023

x

12 Total penalty months 12

=

$45.36 Additional fees Joe will pay in a year

Part C enrollment windows

Though there are no late enrollment penalties associated with Part C, or Medicare Advantage, plans, there are certain times when you can sign up or make changes to your coverage. These include:

- During your IEP

- During Annual Enrollment Period (October 15 to December 7)

- During Open Enrollment Period (January 1 to March 31)

- During a Special Enrollment Period

When preparing to enroll in Medicare, be sure to follow your enrollment schedule. Not only will this help ensure you have uninterrupted coverage, but it will also prevent you from paying penalty fees.

About the author

Bonnie Vengrow is a journalist based in NYC who has written for Parents, Prevention, Rodale’s Organic Life, Good Housekeeping and others. She’s never met a hiking trail she doesn’t like and is currently working on perfecting her headstand in yoga class.