The information you will be accessing is provided by another organization or vendor. If you do not intend to leave our site, close this message.

Medicare Supplement insurance plans may offer you freedom

Medicare Supplement insurance plans may offer you freedom

With a Medicare Supplement plan, you’ll enjoy a variety of benefits, including:

- No restrictive provider networks

- The freedom to visit any physician, specialist or hospital that accepts Medicare patients

- Coverage that goes with you when you travel

A variety of plans to choose from

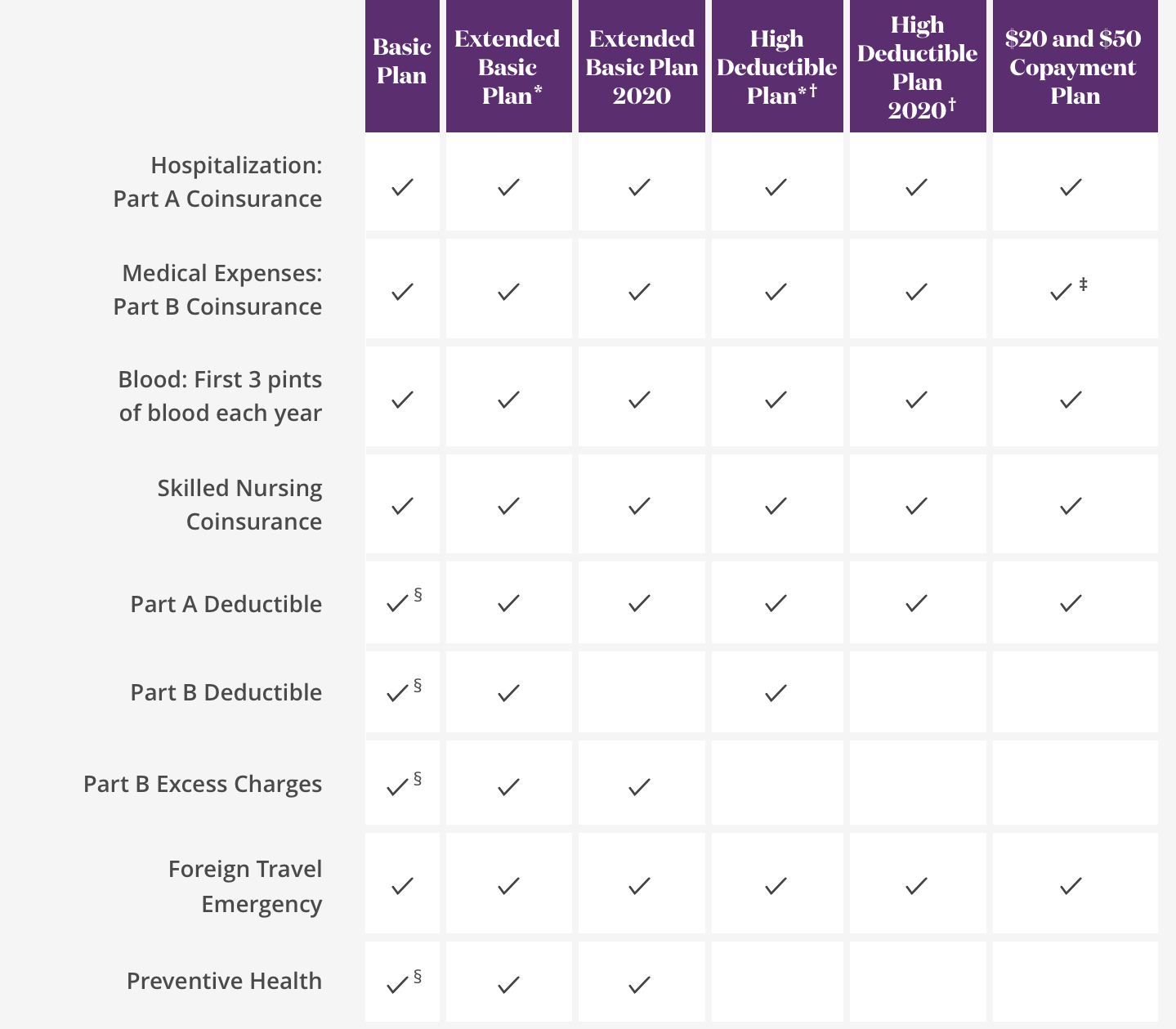

Here’s a brief overview of the various Medicare Supplement Insurance plans and the benefits they include. (Note that all plans shown may not be available in all states for all situations.)

Basic Plan

- Hospitalization: Part A Coinsurance

- Medical Expenses: Part B Coinsurance

- Blood: First 3 pints of blood each year

- Skilled Nursing Coinsurance

- Part A Deductible §

- Part B Deductible §

- Part B Excess Charges §

- Foreign Travel Emergency

- Preventive Health §

§ Optional Rides are available for the Part A deductible, Part B deductible, Part B excess and Preventive Health Services. Part B deductible rider available only for people first eligible for Medicare before 2020.

Extended Basic Plan*

- Hospitalization: Part A Coinsurance

- Medical Expenses: Part B Coinsurance

- Blood: First 3 pints of blood each year

- Skilled Nursing Coinsurance

- Part A Deductible

- Part B Deductible

- Part B Excess Charges

- Foreign Travel Emergency

- Preventive Health

* Available for Applicants first eligible for Medicare before 2020 only.

Extended Basic Plan 2020

- Hospitalization: Part A Coinsurance

- Medical Expenses: Part B Coinsurance

- Blood: First 3 pints of blood each year

- Skilled Nursing Coinsurance

- Part A Deductible

- Part B Excess Charges

- Foreign Travel Emergency

- Preventive Health

High Deductible Plan* †

- Hospitalization: Part A Coinsurance

- Medical Expenses: Part B Coinsurance

- Blood: First 3 pints of blood each year

- Skilled Nursing Coinsurance

- Part A Deductible

- Part B Deductible

- Foreign Travel Emergency

* Available for Applicants first eligible for Medicare before 2020 only.

† High Deductible plan will pay coverage upon payment of the annual deductible. For 2020, the deductible amount is $2,300. This amount will be adjusted to reflect the changes in Medicare.

High Deductible Plan 2020 †

- Hospitalization: Part A Coinsurance

- Medical Expenses: Part B Coinsurance

- Blood: First 3 pints of blood each year

- Skilled Nursing Coinsurance

- Part A Deductible

- Foreign Travel Emergency

† High Deductible plan will pay coverage upon payment of the annual deductible. For 2020, the deductible amount is $2,300. This amount will be adjusted to reflect the changes in Medicare.

$20 and $50 Copayment Plan

- Hospitalization: Part A Coinsurance

- Medical Expenses: Part B Coinsurance ‡

- Blood: First 3 pints of blood each year

- Skilled Nursing Coinsurance

- Part A Deductible

- Foreign Travel Emergency

‡ Copayment plan requires a $20 copayment for office visits and a $50 copayment for emergency room visits. Copayments do not count toward the annual Part B deductible.

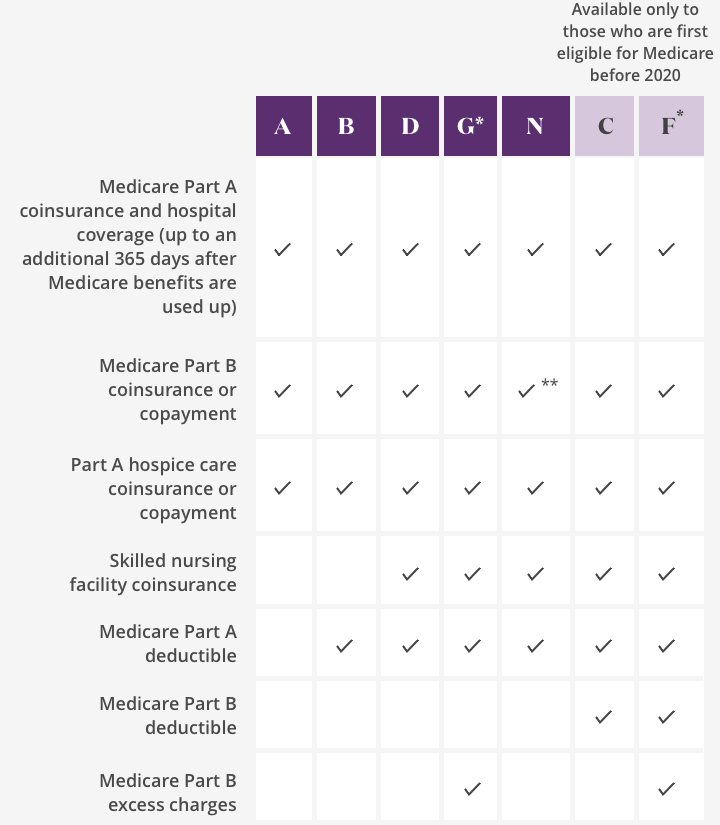

The following plans are available to all applicants:

Plan A

Plan B

Plan D

Plan G*

Plan N

* High-deductible Plan F and Plan G are also available; same benefits apply once calendar-year deductible is paid.

The following plans are available only to those who are first eligible for Medicare before 2020:

Plan C

Plan F*

* High-deductible Plan F and Plan G are also available; same benefits apply once calendar-year deductible is paid.

The following plans include Medicare Part A coinsurance and hospital coverage (up to an additional 365 days after Medicare benefits are used up):

Plan A

Plan B

Plan D

Plan G*

Plan N

Plan C

Plan F*

The following plans include Medicare Part B coinsurance or copayment:

Plan A

Plan B

Plan D

Plan G*

Plan N**

Plan C

Plan F*

* High-deductible Plan F and Plan G are also available; same benefits apply once calendar-year deductible is paid.

** Plan N requires a $20 copayment for office visits and a $50 copayment for emergency room visits. Copayments do not count toward the annual Part B deductible.

The following plans include Part A hospice care coinsurance or copayment:

Plan A

Plan B

Plan D

Plan G*

Plan N

Plan C

Plan F*

* High-deductible Plan F and Plan G are also available; same benefits apply once calendar-year deductible is paid.

The following plans include skilled nursing facility coinsurance:

Plan D

Plan G*

Plan N

Plan C

Plan F*

* High-deductible Plan F and Plan G are also available; same benefits apply once calendar-year deductible is paid.

The following plans include a Medicare Part A deductible:

Plan B

Plan D

Plan G*

Plan N

Plan C

Plan F*

* High-deductible Plan F and Plan G are also available; same benefits apply once calendar-year deductible is paid.

The following plans include a Medicare Part B deductible:

Plan C

Plan F*

* High-deductible Plan F and Plan G are also available; same benefits apply once calendar-year deductible is paid.

The following plans include Medicare Part B excess charges:

Plan G*

Plan F*

* High-deductible Plan F and Plan G are also available; same benefits apply once calendar-year deductible is paid.

* Available for Applicants first eligible for Medicare before 2020 only.

† High Deductible plan will pay coverage upon payment of the annual deductible. For 2020, the deductible amount is $2,300. This amount will be adjusted to reflect the changes in Medicare.

‡ Copayment plan requires a $20 copayment for office visits and a $50 copayment for emergency room visits. Copayments do not count toward the annual Part B deductible.

§ Optional Rides are available for the Part A deductible, Part B deductible, Part B excess and Preventive Health Services. Part B deductible rider available only for people first eligible for Medicare before 2020.

Call us

Talk to a licensed agent at ${medsupenroll}

${tty} ${medsupphours}