The information you will be accessing is provided by another organization or vendor. If you do not intend to leave our site, close this message.

If you enroll in Medicare, what happens to your dependents?

By Bonnie Gibbs Vengrow

By Bonnie Gibbs Vengrow

You work hard to take care of your family. And part of taking care of your loved ones involves making sure they have the health care coverage they need.

But if you decide to sign up for Medicare and drop your employer coverage, your dependents who are covered by your employer-sponsored plan may need to find another form of health insurance. The good news is your dependents have options when it comes to finding new health coverage.

So, who is considered a “dependent”? In most cases, only those people who are related to you by blood, marriage or adoption, such as your spouse or children, are classified as dependents.

What to consider when exploring alternative coverage for your dependents

When exploring other health coverage options for your dependents, you and your loved ones may want to consider the following:

- Whether a plan offers coverage for prescription drugs, dental and vision

- The cost of copayments, premiums and deductibles

- Whether preventive care services are covered

- Whether the plan’s network includes their doctors and preferred hospital

Let’s break down the types of health insurance available to your loved ones.

Purchase health insurance from a private insurer

When you should consider: Your dependent is not yet eligible for Medicare but is 26 years of age or older with no employer coverage.

One way for your dependents to get coverage is to purchase a health insurance plan from a private insurance company.

The details of their coverage will vary based on a range of factors including age, location, income, personal choices and insurer. You and your dependents may find that a plan from a private insurance company can be just as affordable as an employer-sponsored plan.

These plans can be purchased during certain times of the year through a government exchange or marketplace, or directly from a private insurance company. Let’s look at both options.

Purchase a plan directly from an insurer

If your dependents are buying a plan from a health insurance company, they’ll have no shortage of options. Researching what plans are available in their area based on their coverage needs and budget can help narrow down the choices.

Note that plans purchased from an insurer typically do not offer financial assistance.

Get up to speed on health insurance basics by reading the article “How health insurance works: The ultimate guide.”

Purchase a plan through a government exchange (ACA)

Plans sold through a federal or state-run exchange are often referred to as Affordable Care Act (ACA) plans or “Obamacare.” Virtually all ACA plans cover 10 essential health benefits, including hospitalization, prescription drugs and mental health services.

Costs vary based on plan type, insurer, age and other factors. Income-based tax credits and cost-sharing reductions are available to those who qualify.

Sign up for short-term coverage through COBRA

When you should consider: Your dependent is a spouse or dependent child who needs temporary coverage.

If your dependents need short-term coverage until they’re eligible for Medicare or while they look for a plan from a private insurer, the Consolidated Omnibus Budget Reconciliation Act, or COBRA, may be an option worth considering. COBRA allows eligible dependents to keep their same employer-sponsored insurance coverage for a limited amount of time. Coverage typically lasts up to 18 months, but in some circumstances could extend up to 36 months. Because the specifics of COBRA can vary based on individual circumstances, it’s important to speak with the human resources representative or benefits manager at your workplace to discuss the details of potential COBRA coverage.

It’s important to remember that COBRA can be an expensive option. That’s because your dependents are responsible for the entire premium, including whatever portion your employer may have paid in the past.

To learn more about how COBRA works, read “Leaving your job? We answer your top 5 questions about COBRA benefits.”

If you’re considering enrolling in Medicare, it’s important to understand early on how the change in coverage may impact your dependents. As you and your dependents compare options, you may want to keep a few factors top of mind, such as what the plan covers, whether their doctors and preferred hospitals are in network, and the cost of copayments, premiums and deductibles. Understanding the different forms of health insurance available can go a long way toward helping your loved ones find the plan that suits your family’s needs.

Enroll in Medicare

When you should consider: Your dependent is 65 years old or older or is a younger person with either a disability, ALS (also called Lou Gehrig’s disease) or end-stage renal disease.

If you’re planning to enroll in Medicare, you may be wondering if a spouse can claim Medicare spousal benefits. Or if your child can be on your Medicare plan. The short answer is that there are no Medicare spouse benefits, and your family cannot join your Medicare plan.

However, if they meet the conditions above, they may be eligible to sign up for their own Medicare plan. Eligible members of your family can only enroll in Medicare during certain times, such as their initial enrollment period (IEP) or a Special Enrollment Period (SEP).

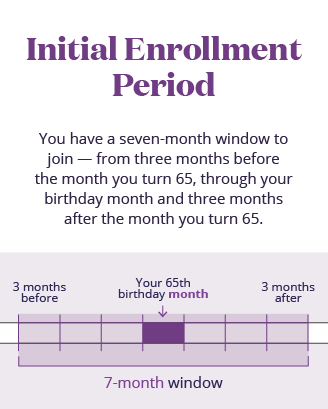

Initial Enrollment Period

You have a seven-month window to join – from three months before the month you turn 65, through your birthday month and three months after the month you turn 65.

This includes

- 3 months before

- Your 65th birthday month

- 3 months after

- 7-month window

Initial Enrollment Period

You have a seven-month window to join – from three months before the month you turn 65, through your birthday month and three months after the month you turn 65.

This includes

- 3 months before

- Your 65th birthday month

- 3 months after

- 7-month window

If your loved one is considering joining a Medicare Advantage plan, they must enroll in Medicare Parts A and B first.

Want to learn more about the different parts of Medicare? Read “Unpacking the parts of Medicare: Parts A, B, C, D and Medicare Supplement plans.”

To understand when your loved ones may be able to sign up for Medicare, read “Unpacking Medicare: What you need to know about Medicare enrollment periods (and when you can change your plan).”