The information you will be accessing is provided by another organization or vendor. If you do not intend to leave our site, close this message.

How to use Medicare to stay financially healthy

By Bonnie Vengrow

By Bonnie Vengrow

Medicare will help pay for care in and out of the hospital. And, depending on the type of coverage you have, maybe some other services as well. But no plan covers everything. Even on Medicare, smaller unexpected costs can add up quickly.

“A local broker can be an invaluable resource,” says Kelly Jones, an Aetna Medicare broker manager in the Northwest Mountain market. “They’re local. They’re independent. They represent several companies that are out there,” she explains. “They’re going to be able to look at your needs and bring those plans to you that are likely the best fit.”

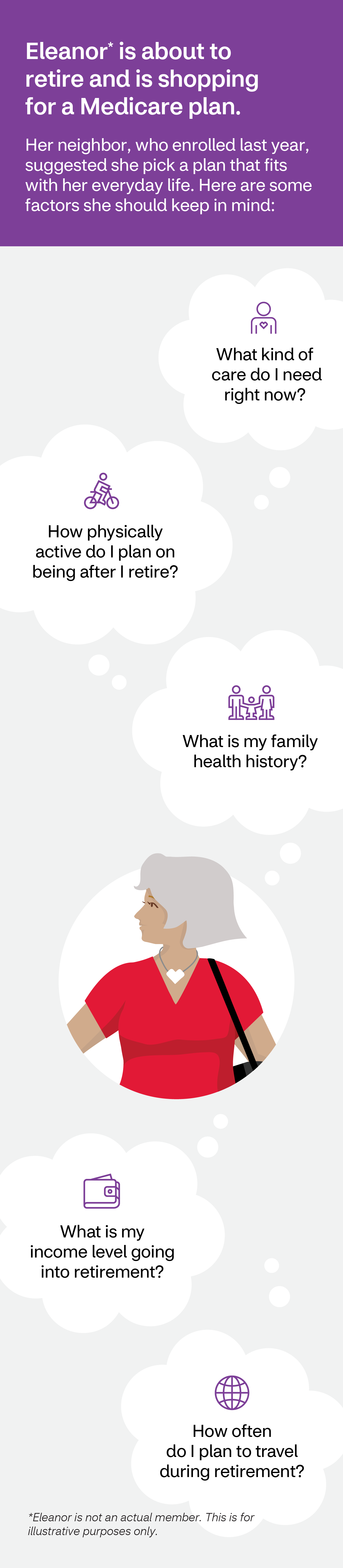

You should also think about the factors that go into your overall picture of health. For instance, your doctors, expanded care, medications, lifestyle and finances. Let’s take a closer look at what you need to consider.

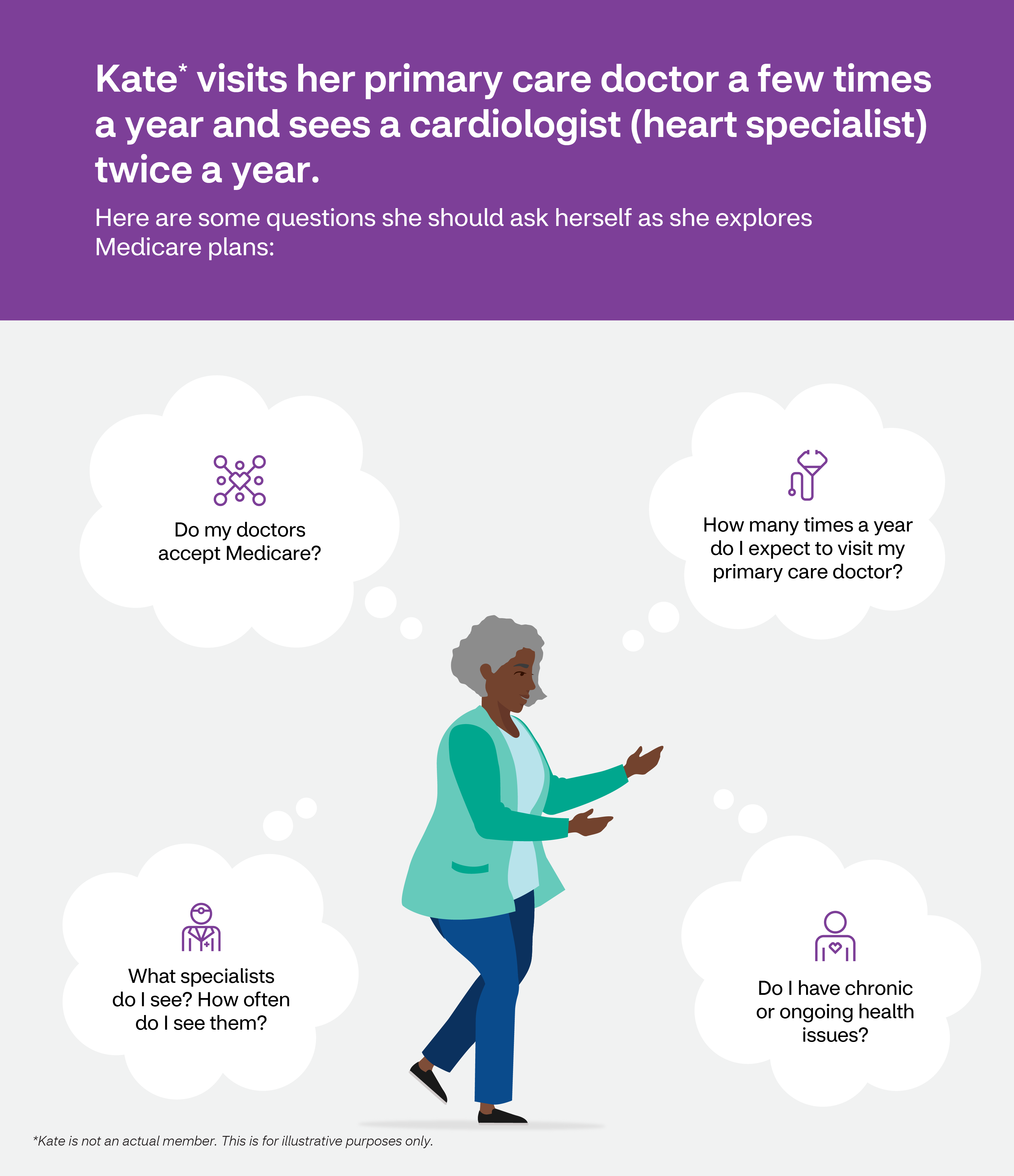

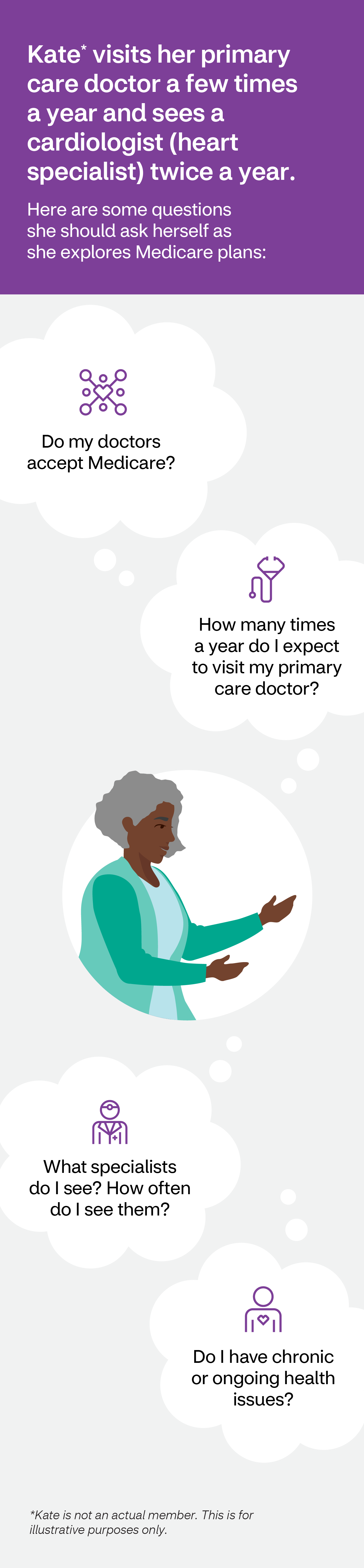

Your doctors

Your doctors are an important part of your health care team. Having a good relationship with them can do wonders for your health. If you’re happy with yours, you’ll want to make sure you can still see them after you get Medicare coverage. This is really important if you have any ongoing or chronic health issues that require frequent checkups during the year.

You’ll want to avoid paying higher out-of-pocket costs or changing doctors. So make sure your health care providers accept your insurance. Original Medicare lets you to go to any doctor or hospital in the country that’s enrolled in Medicare and accepts new Medicare patients. Some types of Medicare Advantage (MA) plans, such as Health Maintenance Organization (HMO) plans, require you to see doctors in their network.

Your expanded care

In addition to ensuring your doctors accept your insurance, Jones recommends asking yourself whether the plans you’re considering cover the care you might need. For instance, prescription eyewear, hearing aids, routine dental visits and fitness classes. MA plans may cover these benefits. Original Medicare (Parts A and B) does not.

If you prefer alternative care, such as acupuncture, massage therapy or chiropractic care, check if the plan covers it. In most cases, Original Medicare doesn’t cover holistic care. But MA plans may cover certain treatments, therapies and medicines.

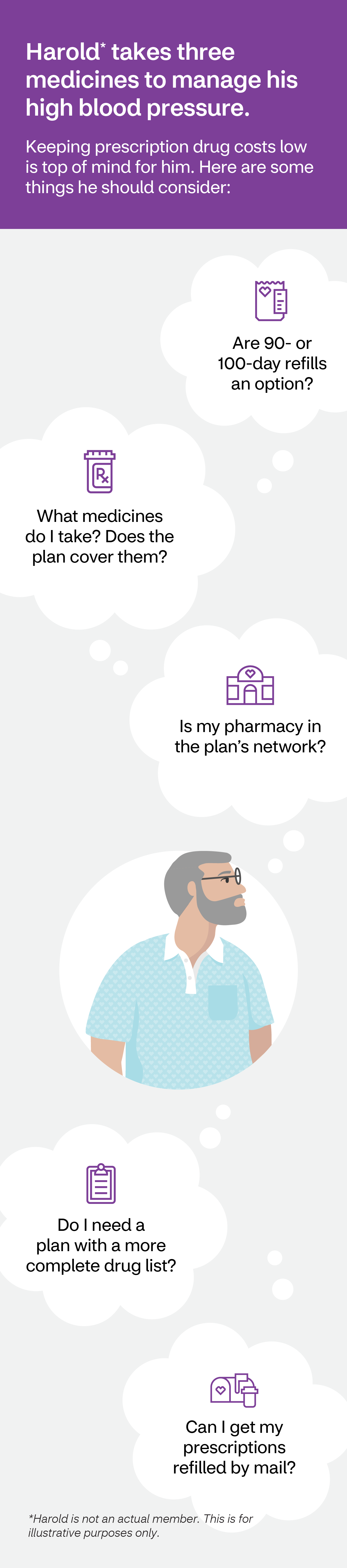

Your medications

Prescription drugs can help keep you healthy. But they can also be costly, especially if you have ongoing health issues. On average, a person covered by Original Medicare who has one or two chronic conditions spent $416 per year on prescription drugs. Those with five or more chronic conditions spent $1,065 per year, according to the Kaiser Family Foundation.

Prescription drug coverage helps keep costs in check. There are two ways to get coverage. You can purchase a stand-alone Medicare Prescription Drug Plan (PDP), also known as a Part D plan, which you can combine with Original Medicare. Or you can get prescription drug coverage as part of a Medicare Advantage plan, which would replace Original Medicare.

Prescription drug coverage will help pay for much of the expense of your medicines. But there are other ways you can help lower the price of drugs.

- Ask your doctor if a generic version of your medicine would be just as effective.

- Find out if the plan covers mail-order prescriptions.

- Consider switching to 90- or 100-day refills. Over time they are usually cheaper and more convenient than 30-day refills.

- Find the formulary (the plan’s list of covered drugs) that’s right for you. You can search using an online formulary lookup tool or work with an agent.

- Once you’re enrolled in a plan, review the plan's formulary each year. Doing so will help to avoid surprise costs.

- If you’re concerned about how you’ll afford your medicine, help may be available to you. Find out if you qualify for Extra Help. It’s a federal program to help people with limited incomes pay for prescription drug costs. Also, some drug companies have programs to help those who qualify pay for their medicines.

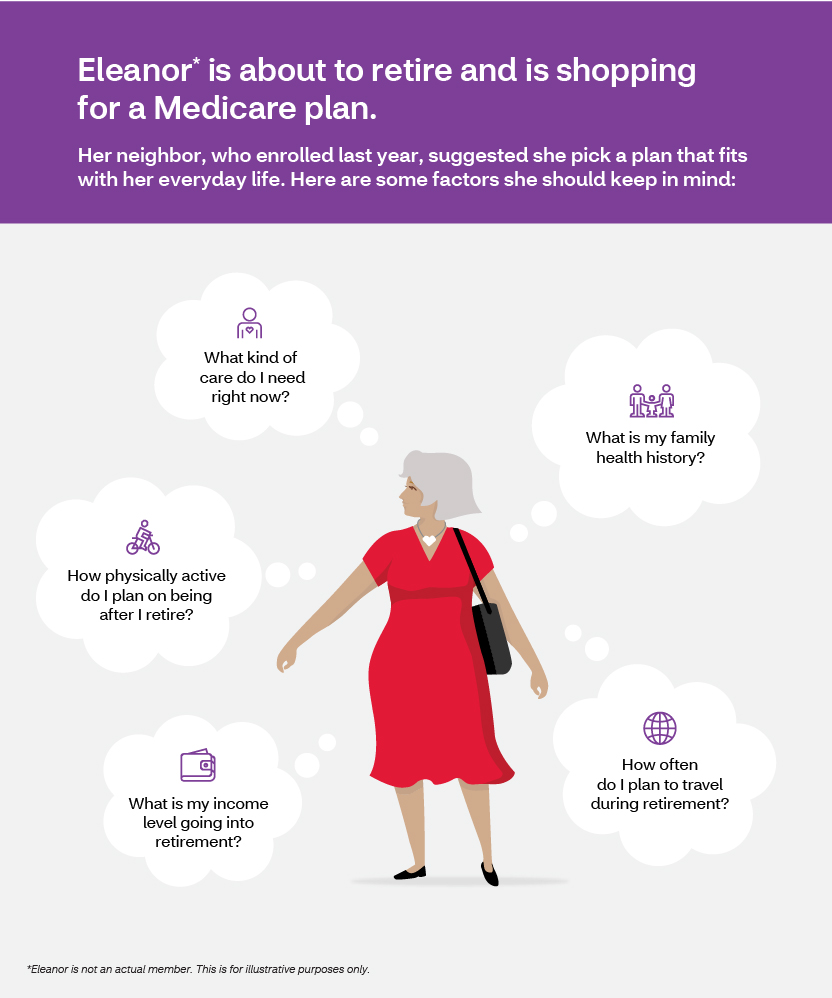

Your lifestyle and finances

Your doctors and your medicines may impact your health care expenses. But so can your lifestyle. Consider your past history of health care. Is there a family history of health issues you need to keep in mind?

At the same time, it’s helpful to think about how you envision your retirement. Then you can find a plan with the right benefits for you. Do you plan on being physically active? Will you spend half of the year traveling or living in another part of the country?

Finally, if you’re about to retire, ask yourself what your income level will be after retirement. “That’s a very important question,” says Jeremy Bridges, an Aetna Medicare broker manager in the MidSouth market. “Now you’re limiting what your income potential may be and you need to mitigate the costs that may come up at a later date, if there’s an emergency.”

If retirement is right around the corner, consider your Medicare options now. You can choose a plan that can cover the care you need and prevent surprise bills. In other words, a plan that will help keep you physically and financially healthy.

About the author

Bonnie Vengrow is a journalist based in NYC who has written for Parents, Prevention, Rodale’s Organic Life, Good Housekeeping and others. She’s never met a hiking trail she doesn’t like and is currently working on perfecting her headstand in yoga class.

About the author

Bonnie Vengrow is a journalist based in NYC who has written for Parents, Prevention, Rodale’s Organic Life, Good Housekeeping and others. She’s never met a hiking trail she doesn’t like and is currently working on perfecting her headstand in yoga class.

©2022 Aetna, Inc.

Y0001_NR_30631_2022_C