5 things to know about Medicare Star Ratings

By Sachi Fujimori

By Sachi Fujimori

When it comes to navigating through many options, expert information can help you make the right decision. Take Medicare, for example. In 2023, the average Medicare beneficiary could choose from among 43 Medicare Advantage plans in their region.

Medicare Star Ratings help you learn which plans perform best in areas you find important. The federal government (the Centers for Medicare and Medicaid Services, also known as CMS) gives an annual rating to Medicare Advantage and Prescription Drug Plans (Part D), based on categories such as:

- Customer service

- Member experience

- Quality of care

Each plan gets one to five stars, with five being the best and one being the worst.

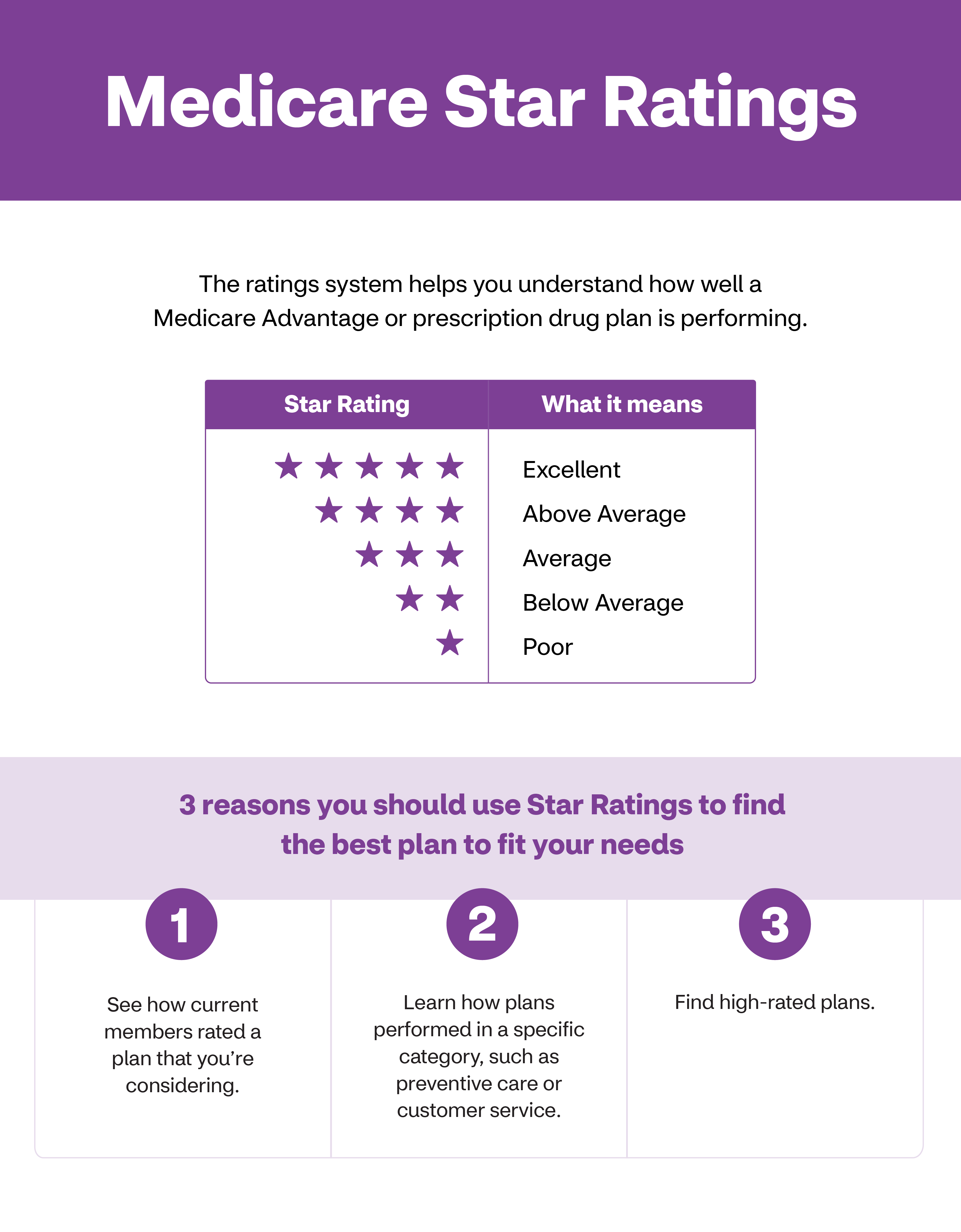

Medicare Star Ratings

The ratings system helps you understand how well a Medicare Advantage or prescription drug plan is performing.

Star Rating |

What it means |

|---|---|

| (five stars) | Excellent |

| (4 stars) | Above Average |

| (3 stars) | Average |

| (2 stars) | Below Average |

| (1 star) | Poor |

3 reasons you should use Star Ratings to find the best plan to fit your needs

- See how current members rated a plan that you’re considering.

- Learn how plans performed in a specific category, such as preventive care or customer service.

- Find high-rated plans.

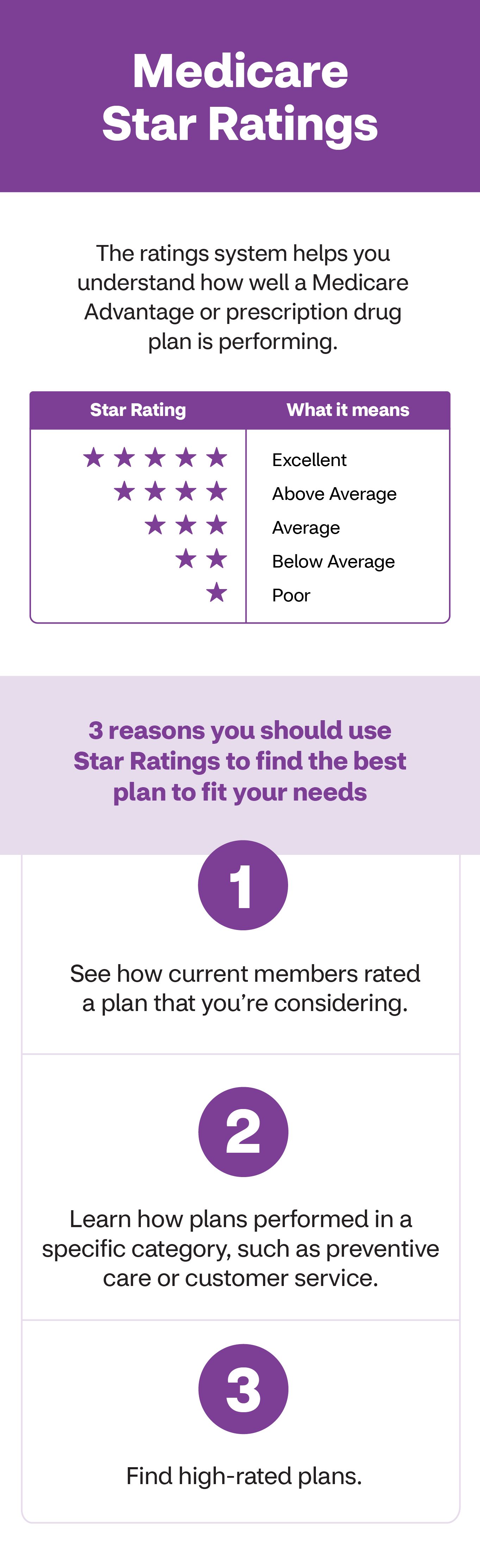

Medicare Star Ratings

The ratings system helps you understand how well a Medicare Advantage or prescription drug plan is performing.

Star Rating |

What it means |

|---|---|

| (five stars) | Excellent |

| (4 stars) | Above Average |

| (3 stars) | Average |

| (2 stars) | Below Average |

| (1 star) | Poor |

3 reasons you should use Star Ratings to find the best plan to fit your needs

- See how current members rated a plan that you’re considering.

- Learn how plans performed in a specific category, such as preventive care or customer service.

- Find high-rated plans.

Every plan is evaluated against the same set of criteria. So you have a good way of seeing how the plans available in your area compare to one another.

“The Medicare Stars Rating is a useful tool for a beneficiary to evaluate potential options,” says Mike Kavouras, Vice President of Medicare Strategic Operations. He works to ensure Aetna delivers benefits, care and service to members in the best way possible. “It rates all of the health plans against the same set of standards, across a broad set of measures. The process is very transparent. While Stars ratings can be a helpful resource when choosing your health plan, ensuring your own health needs are met is most important.”

Whether you’re evaluating plans for yourself or a loved one, here are five facts to consider.

1. Subcategory ratings matter, too

Plans receive an overall performance rating. They also receive ratings in a few subcategories. This helps you see if the plan performs well in a specific area that‘s important to you.

The “staying healthy” category includes whether members got their annual flu shot. And if they reported improvements in their physical health over a two-year period.

The “managing chronic conditions” category measures how well plans help members with long-term conditions such as diabetes, rheumatoid arthritis and high blood pressure. The rating is computed from things like how often patients with diabetes receive recommended screenings and is able to see a specialist. Or if patients with rheumatoid arthritis were prescribed proper medications.

“Maybe you don’t have a lot of clinical conditions to manage, but health care is very confusing to you. Then for you, having a very high degree of service may be top of mind. But, for other individuals wrestling with multiple chronic conditions, understanding how the plan that they’d choose can help support them in their health may be of most interest,” Kavouras adds.

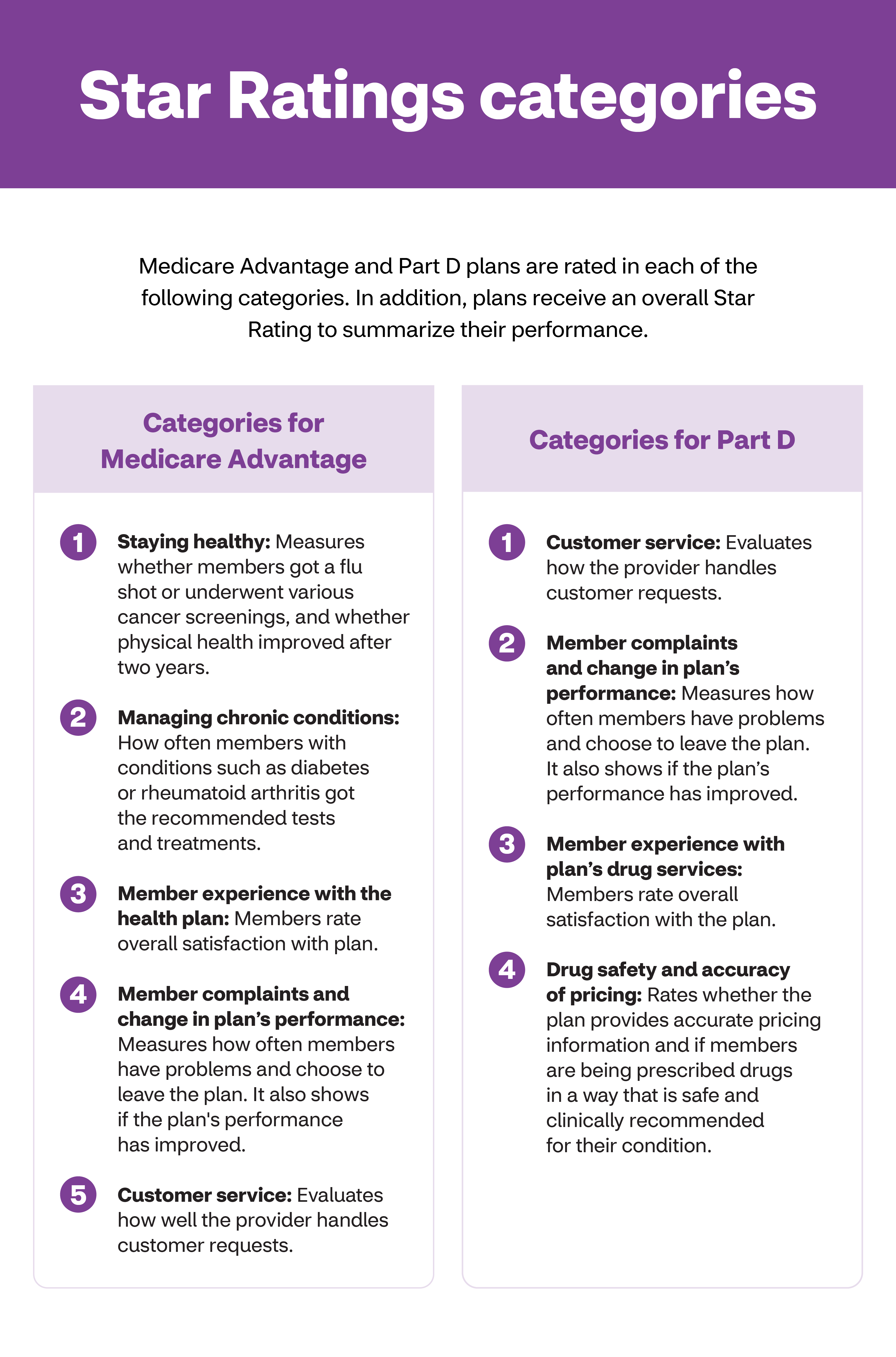

Star Ratings categories

Medicare Advantage and Part D plans are rated in each of the following categories. In addition, plans receive an overall Star Rating to summarize their performance.

Categories for Medicare Advantage

1. Staying healthy: Measures whether members got a flu shot or underwent various cancer screenings, and whether physical health improved after two years.

2. Managing chronic conditions: How often members with conditions such as diabetes or rheumatoid arthritis got the recommended tests and treatments.

3. Member experience with the health plan: Members rate overall satisfaction with plan.

4. Member complaints and change in plan’s performance: Measures how often members have problems and choose to leave the plan. It also shows if the plan's performance has improved.

5. Customer service: Evaluates how well the provider handles customer requests.

Categories for Part D

1. Customer service: Evaluates how the provider handles customer requests.

2. Member complaints and change in plan’s performance: Measures how often members have problems and choose to leave the plan. It also shows if the plan’s performance has improved.

3. Member experience with plan's drug services: Members rate overall satisfaction with the plan.

4. Drug safety and accuracy of pricing: Rates whether the plan provides accurate pricing information and if members are being prescribed drugs in a way that is safe and clinically recommended for their condition.

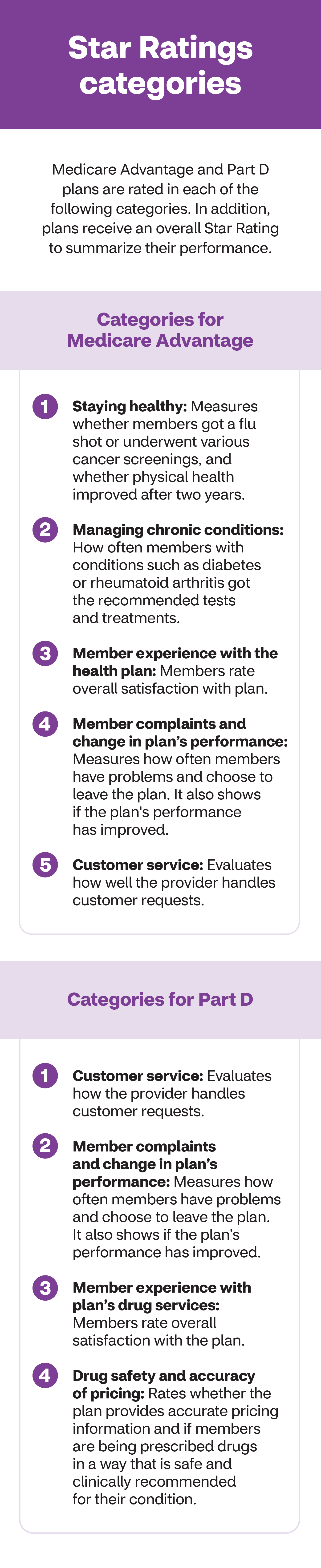

Star Ratings categories

Medicare Advantage and Part D plans are rated in each of the following categories. In addition, plans receive an overall Star Rating to summarize their performance.

Categories for Medicare Advantage

1. Staying healthy: Measures whether members got a flu shot or underwent various cancer screenings, and whether physical health improved after two years.

2. Managing chronic conditions: How often members with conditions such as diabetes or rheumatoid arthritis got the recommended tests and treatments.

3. Member experience with the health plan: Members rate overall satisfaction with plan.

4. Member complaints and change in plan’s performance: Measures how often members have problems and choose to leave the plan. It also shows if the plan's performance has improved.

5. Customer service: Evaluates how well the provider handles customer requests.

Categories for Part D

1. Customer service: Evaluates how the provider handles customer requests.

2. Member complaints and change in plan’s performance: Measures how often members have problems and choose to leave the plan. It also shows if the plan’s performance has improved.

3. Member experience with plan's drug services: Members rate overall satisfaction with the plan.

4. Drug safety and accuracy of pricing: Rates whether the plan provides accurate pricing information and if members are being prescribed drugs in a way that is safe and clinically recommended for their condition.

2. Stars aren’t everything

Star Ratings are helpful. But keep in mind that health plans are not one-size-fits-all. And everyone’s needs are different and might even evolve over time. “If you based your decision solely on Star Ratings, you may end up with a plan that doesn’t fit your needs, and so it’s important to review all of the important factors,” says Kavouras.

A higher performing plan may not be a good match if:

- It doesn’t offer the right mix of doctors or match your sites of care

- Innovative benefits aren't included in the program

- Doesn’t offer your prescription drugs

“These are the things that you should focus on while considering plan quality", adds Kavouras. Read on for the five questions you should be asking to choose the right Medicare plan.

3. The Star Ratings can help you decide

Once you’ve narrowed down your options, Kavouras says the Star Ratings can be a “useful yardstick” in deciding what plan to choose.

“Clearly if you’re deciding between a 4.5-star plan that has your doctors in-network and has your drugs, versus a similar 3-star plan, the Star Ratings can help make the final decision,” he says.

A strong Stars Rating is a good indicator of a company with experience and a stable program.

4. High-performing plans get a bonus

The Star Ratings system rewards higher-performing plans. This means that those with four or more stars receive annual bonus payments from the CMS. The higher the rating, the higher the bonus.

Plans are required by law to spend this bonus money on extra benefits for members, such as vision, hearing or dental coverage.

5. Fall is ratings season

Plan ratings are released every fall. So be sure to check and see how your plan is performing. It can help you decide about your coverage for the following year. To learn more, visit the CMS’s Star Ratings page. And check out our section on understanding enrollment periods to determine how and when you can change your coverage.

About the author

Sachi Fujimori is a writer and editor based in Brooklyn who focuses on writing about science and health. A good day is one where she eats her vegetables and remembers to live in the moment with her baby girl.