The information you will be accessing is provided by another organization or vendor. If you do not intend to leave our site, close this message.

Benefits you can expect and benefits you may be surprised to find out about

By Sachi Fujimori

By Sachi Fujimori

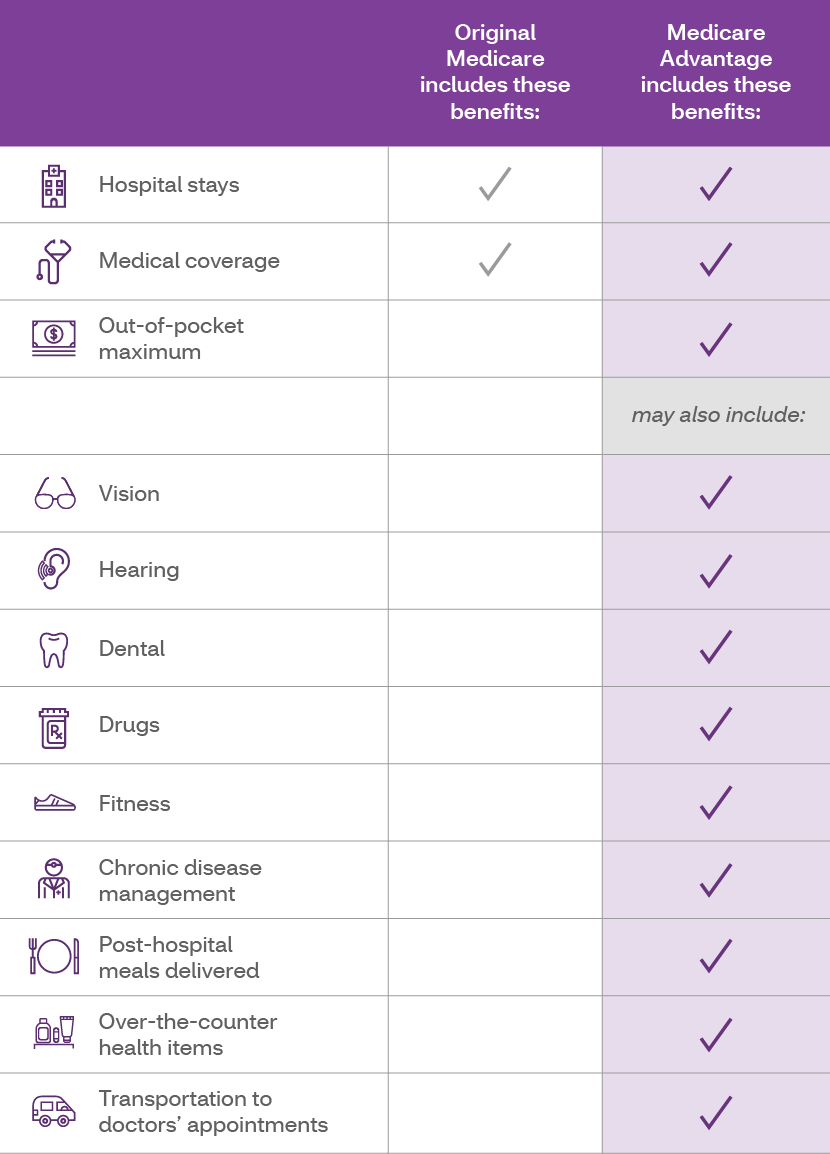

As you’re getting to know your Medicare choices, you may have questions about what’s actually covered. For example, does Medicare cover routine dental work? Does Medicare cover eyeglasses? When it comes to Original Medicare versus Medicare Advantage, there are some key differences in the types of benefits that you’ll get. To help you better understand your options, we have created a guide to Medicare benefits.

Original Medicare vs. Medicare Advantage

It’s a common misconception that Original Medicare, the government-sponsored health care program, covers everything. Original Medicare includes Part A (hospital stays) coverage and Part B (doctor’s visits and medical procedures) coverage. But when you look more closely, you’ll see that it does not cover things like routine hearing, dental and vision health. Original Medicare also does not provide prescription drug coverage. If you want your prescriptions covered with Original Medicare, in most cases, you will need to join a separate Medicare prescription drug plan (Part D).

According to Angela Hauser, a broker manager with Aetna®, “A lot of people believe that Original Medicare is the end-all be-all when in fact, it’s kind of a building block for whatever else you do, and there are a lot of holes in Original Medicare coverage.”

But with Medicare Advantage (MA), you get Parts A and B and also more. In many cases you get extras, such as hearing, vision and dental coverage and gym memberships. Many Medicare Advantage plans also include prescription drug coverage.

Some people may wonder how it’s possible to get these extra benefits with an MA plan and at the same time have little to no additional monthly premium. That’s because unlike Original Medicare, MA plans are managed by private insurance companies. Aetna MA plans use their large health care network to deliver improved value to members. "We offer members access to strong providers and negotiate lower prices.

Original Medicare also doesn’t offer the protection of an out-of-pocket spending limit. This is a cap on how much of your own money you spend on health care bills in a given year. However, all MA plans have an out-of-pocket limit.

Extra benefits

One of the main advantages of MA plans is that many include vision, dental and hearing coverage.

With most Aetna MA plans, you have a network benefit or an allowance to pay for these services. This coverage may include:

- Dental coverage, including annual cleanings, X-rays and fillings

- Annual routine eye exam and coverage for eyeglasses and contacts

- An annual hearing exam and hearing aid fitting

In addition, some MA plans, known as MAPD plans, include drug coverage. As mentioned above, you can purchase a Part D (drug plan) separately, but the advantage of an MAPD plan is that you get all your benefits under one umbrella. “Instead of having multiple cards and multiple places administering your benefits, you have one company that’s going to handle it for you,” says Hauser.

With Aetna MA plans, you also get a SilverSneakers® fitness benefit, which provides gym access and fitness classes. Several home-based fitness options are also available, including on-demand classes and rotating home-based kits.

Surprising benefits

While Medicare Advantage plans can contain a number of extra benefits, individual plans can vary greatly, so it’s important to research which benefits a plan includes. Here’s a look at some of the lesser-known benefits that may be included with some Aetna MA plans:

- Chronic disease managers to help you manage your health

- Fall-prevention benefits, such as home and bathroom safety items

- Over-the-counter (OTC) allowance: a set amount of money (included with your premium) quarterly to spend on certain OTC health care items such as Band-Aids and sunscreen

- Healthy meals delivered to your home after being discharged from the hospital or skilled nursing facility

- Alternative therapies like acupuncture or therapeutic massage

- Transportation to and from doctors’ appointments

With MA plans, you can get benefits not typically covered by Original Medicare. And with a variety of Aetna MA plan types, you have the freedom to decide the level of coverage that best fits your needs. Many of the extra benefits we offer can help you take a proactive approach to living your healthiest life possible.

Aetna Medicare is a HMO, PPO plan with a Medicare contract. Our SNPs also have contracts with State Medicaid programs. Enrollment in our plans depends on contract renewal. The provider network may change at any time. You will receive notice when necessary. Participating physicians, hospitals and other health care providers are independent contractors and are neither agents nor employees of Aetna. The availability of any particular provider cannot be guaranteed, and provider network composition is subject to change. See Evidence of Coverage for a complete description of plan benefits, exclusions, limitations and conditions of coverage. Plan features and availability may vary by service area.

About the author

Sachi Fujimori is a writer and editor based in Brooklyn who focuses on writing about science and health. A good day is one where she eats her vegetables and remembers to live in the moment with her baby girl.