Not a member?

Call us at ${medsupenroll} ${tty} ${medsupphours}

Your coverage can’t be changed or canceled when you move anywhere within the United States, as long as you pay your premiums on time.

You’ll find plans that cover emergency care when you’re out of the country.

You can see any doctor who accepts Medicare patients. There are no network restrictions.

There are many different Medicare Supplement Insurance plans, so it’s important to understand what each plan covers and how federal law affects your eligibility.

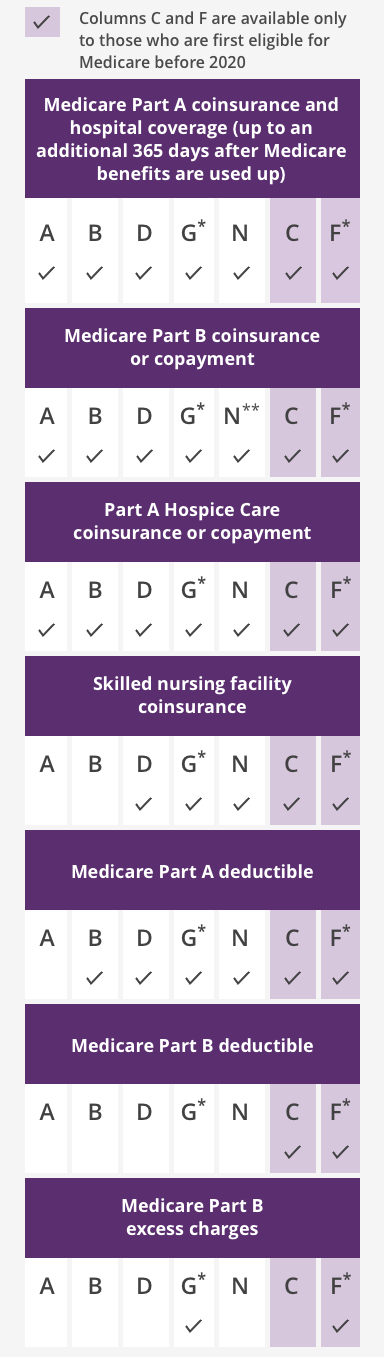

The following plans are available to all applicants:

* High-deductible Plan F and Plan G are also available; same benefits apply once calendar-year deductible is paid.

The following plans are available only to those who are first eligible for Medicare before 2020:

* High-deductible Plan F and Plan G are also available; same benefits apply once calendar-year deductible is paid.

The following plans include Medicare Part A coinsurance and hospital coverage (up to an additional 365 days after Medicare benefits are used up):

The following plans include Medicare Part B coinsurance or copayment:

* High-deductible Plan F and Plan G are also available; same benefits apply once calendar-year deductible is paid.

** Plan N requires a $20 copayment for office visits and a $50 copayment for emergency room visits. Copayments do not count toward the annual Part B deductible.

The following plans include Part A hospice care coinsurance or copayment:

* High-deductible Plan F and Plan G are also available; same benefits apply once calendar-year deductible is paid.

The following plans include skilled nursing facility coinsurance:

* High-deductible Plan F and Plan G are also available; same benefits apply once calendar-year deductible is paid.

The following plans include a Medicare Part A deductible:

* High-deductible Plan F and Plan G are also available; same benefits apply once calendar-year deductible is paid.

The following plans include a Medicare Part B deductible:

* High-deductible Plan F and Plan G are also available; same benefits apply once calendar-year deductible is paid.

The following plans include Medicare Part B excess charges:

* High-deductible Plan F and Plan G are also available; same benefits apply once calendar-year deductible is paid.

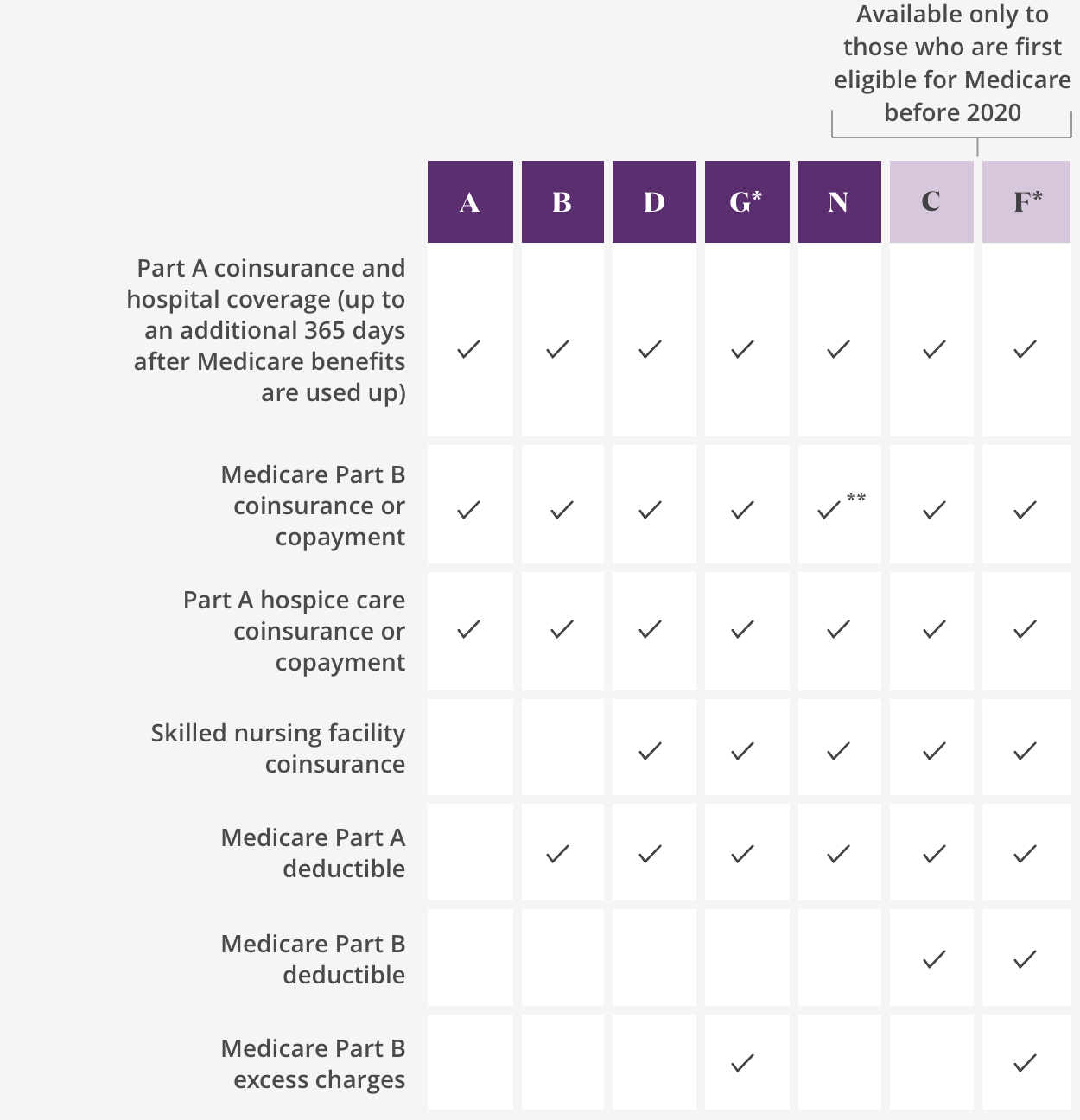

The following plans are available to all applicants:

* High-deductible Plan F and Plan G are also available; same benefits apply once calendar-year deductible is paid.

The following plans are available only to those who are first eligible for Medicare before 2020:

* High-deductible Plan F and Plan G are also available; same benefits apply once calendar-year deductible is paid.

The following plans include Medicare Part A coinsurance and hospital coverage (up to an additional 365 days after Medicare benefits are used up):

The following plans include Medicare Part B coinsurance or copayment:

* High-deductible Plan F and Plan G are also available; same benefits apply once calendar-year deductible is paid.

** Plan N requires a $20 copayment for office visits and a $50 copayment for emergency room visits. Copayments do not count toward the annual Part B deductible.

The following plans include Part A hospice care coinsurance or copayment:

* High-deductible Plan F and Plan G are also available; same benefits apply once calendar-year deductible is paid.

The following plans include skilled nursing facility coinsurance:

* High-deductible Plan F and Plan G are also available; same benefits apply once calendar-year deductible is paid.

The following plans include a Medicare Part A deductible:

* High-deductible Plan F and Plan G are also available; same benefits apply once calendar-year deductible is paid.

The following plans include a Medicare Part B deductible:

* High-deductible Plan F and Plan G are also available; same benefits apply once calendar-year deductible is paid.

The following plans include Medicare Part B excess charges:

* High-deductible Plan F and Plan G are also available; same benefits apply once calendar-year deductible is paid.

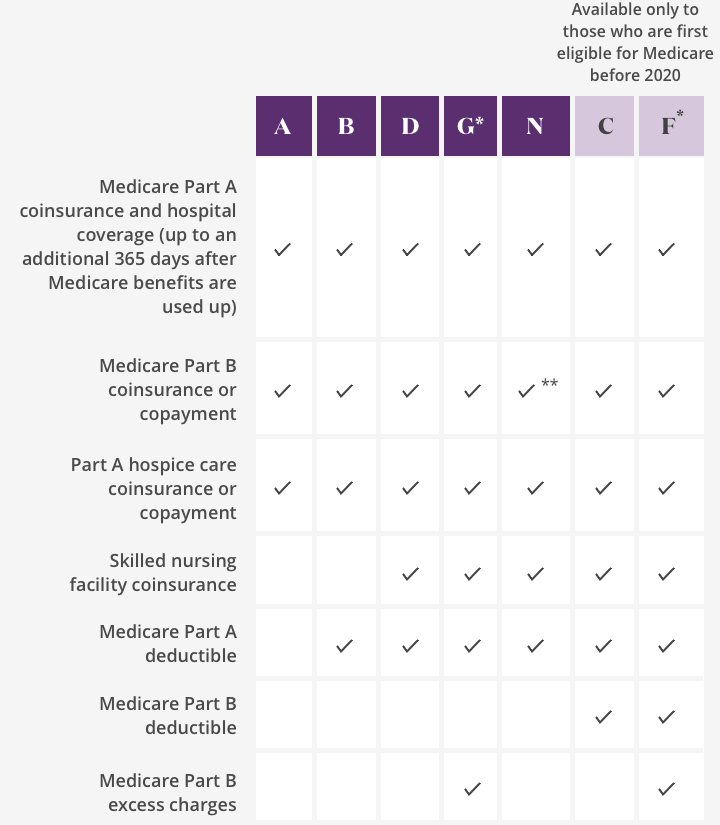

The following plans are available to all applicants:

Plan A

Plan B

Plan D

Plan G*

Plan N

* High-deductible Plan F and Plan G are also available; same benefits apply once calendar-year deductible is paid.

The following plans are available only to those who are first eligible for Medicare before 2020:

Plan C

Plan F*

* High-deductible Plan F and Plan G are also available; same benefits apply once calendar-year deductible is paid.

The following plans include Medicare Part A coinsurance and hospital coverage (up to an additional 365 days after Medicare benefits are used up):

Plan A

Plan B

Plan D

Plan G*

Plan N

Plan C

Plan F*

The following plans include Medicare Part B coinsurance or copayment:

Plan A

Plan B

Plan D

Plan G*

Plan N**

Plan C

Plan F*

* High-deductible Plan F and Plan G are also available; same benefits apply once calendar-year deductible is paid.

** Plan N requires a $20 copayment for office visits and a $50 copayment for emergency room visits. Copayments do not count toward the annual Part B deductible.

The following plans include Part A hospice care coinsurance or copayment:

Plan A

Plan B

Plan D

Plan G*

Plan N

Plan C

Plan F*

* High-deductible Plan F and Plan G are also available; same benefits apply once calendar-year deductible is paid.

The following plans include skilled nursing facility coinsurance:

Plan D

Plan G*

Plan N

Plan C

Plan F*

* High-deductible Plan F and Plan G are also available; same benefits apply once calendar-year deductible is paid.

The following plans include a Medicare Part A deductible:

Plan B

Plan D

Plan G*

Plan N

Plan C

Plan F*

* High-deductible Plan F and Plan G are also available; same benefits apply once calendar-year deductible is paid.

The following plans include a Medicare Part B deductible:

Plan C

Plan F*

* High-deductible Plan F and Plan G are also available; same benefits apply once calendar-year deductible is paid.

The following plans include Medicare Part B excess charges:

Plan G*

Plan F*

* High-deductible Plan F and Plan G are also available; same benefits apply once calendar-year deductible is paid.

* High-deductible Plan F and Plan G are also available; same benefits apply once calendar-year deductible is paid.

** Plan N requires a $20 copayment for office visits and a $50 copayment for emergency room visits. Copayments do not count toward the annual Part B deductible.

Plans are not available in some states and regions. Check your state’s Medicare Supplement Outline of Coverage for exact plan offerings.

You can apply if you:

Remember to review:

Choosing a Medigap Policy: A Guide to Health Insurance for People with Medicare

Call us at ${medsupenroll} ${tty} ${medsupphours}

Call us at 1-888-624-6290 ${tty}, Monday to Friday, 7 AM to 7 PM CT

Aetna is the brand name for insurance products issued by the subsidiary insurance companies controlled by Aetna, Inc. The Medicare Supplement Insurance Plans are insured by Continental Life Insurance Company of Brentwood, Tennessee, an Aetna Company (Aetna), American Continental Insurance Company (Aetna), Aetna Health and Life Insurance Company (Aetna), Aetna Life Insurance Company (Aetna), or Aetna Health Insurance Company (Aetna).

Not connected with or endorsed by the U.S. Government or the Federal Medicare Program.

This is a solicitation of insurance. Contact may be made by a Licensed Insurance Agent or Insurance Company. The Medicare Supplement Insurance Plans are “guaranteed renewable” as long as the required premium is paid by the end of each grace period. The policies have exclusions, limitations, terms under which the policy may be continued in force or discontinued. Plans do not pay benefits for any service and supply of a type not covered by Medicare, including but not limited to dental care or treatment, eyeglasses and hearing aids. See Plan documents for a complete description of benefits, exclusions, limitations and conditions of coverage. AN OUTLINE OF COVERAGE IS AVAILABLE UPON REQUEST. In some states, Medicare Supplement Insurance Plans are available to under age 65 individuals that are eligible for Medicare due to disability or ESRD (end stage renal disease). Plans not available in all States.

In Colorado: All Medicare Supplement standardized plans are offered to qualified individuals under 65.

Policy forms issued in OR include CLIMSP10A OR, CLIMSP10B OR, CLIMSP10F OR, CLIMSP10HF OR, CLIMSP10G OR, and CLIMSP10N OR. In ID, include AHLMSP17A ID, AHLMSP17B ID, AHLMSP17F ID, AHLMSP17HF ID, AHLMSP17G ID, and AHLMSP17N ID. In OK, include AHIMSP18A OK, AHIMSP18B OK, AHIMSP18F OK, AHIMSP18HF OK, AHIMSP18G OK, and AHIMSP18N OK. In TN, include CLIMSP19A TN, CLIMSP19B TN, CLIMSP19F TN, CLIMSP19G TN, CLIMSP19HG TN, and CLIMSP19N TN. In FL, include CLIMSP19A FL, CLIMSP19B FL, CLIMSP19F FL, CLIMSP19G FL, and CLIMSP19N FL. In OH, include CLIMSP19A OH, CLIMSP19B OH, CLIMSP19F OH, CLIMSP19G OH, CLIMSP19HG OH, and CLIMSP19N OH. In MO, AHLMSP18A MO, AHLMSP18B MO, AHLMSP18F MO, AHLMSP18G MO, AHLMSP18HF MO, and AHLMSP18N MO. In MD, AHIMSP19A MD, AHIMSP19B MD, AHIMSP19F MD, AHIMSP19G MD, AHIMSP19HG MD, and AHIMSP19N MD. IN NH, AHLMSP18A NH, AHLMSP18B NH, AHLMSP18F NH, AHLMSP18HF NH, AHLMSP18G NH, AHLMSP18N NH. In VA, CLIMSP19A VA, CLIMSP19B VA, CLIMSP19F VA, CLIMSP19G VA, CLIMSP19HG VA, CLIMSP19N VA.

Plan F is available only to those first eligible before 2020.

Medicare Supplement rates based on issue age are valid only for enrollments with coverage starting before March 1, 2022.

Exclusions and Limitations:

1. Loss incurred while your policy is not in force, except as provided in the Extension of Benefits section of your policy;

2. Hospital or Skilled Nursing Facility confinement incurred during a Medicare Part A Benefit Period that begins while this policy is not in force;

3. That portion of any Loss incurred which is paid for by Medicare;

4. Services for non-Medicare Eligible Expenses, including, but not limited to, routine exams, take-home drugs and eye refractions;

5. Services for which a charge is not normally made in the absence of insurance;

6. Loss that is payable under any other Medicare supplement insurance policy or certificate; or

7. Loss that is payable under any other insurance which paid benefits for the same Loss on an expense incurred basis.

Aetna handles premium payments through InstaMed, a trusted payment service.

Aetna handles premium payments through InstaMed, a trusted payment service.

Aetna handles premium payments through InstaMed, a trusted payment service. Your InstaMed log in may be different from your Caremark.com secure member site log in.

Aetna handles premium payments through Payer Express, a trusted payment service. Your Payer Express log in may be different from your Aetna secure member site log in.

The information you will be accessing is provided by another organization or vendor. If you do not intend to leave our site, close this message.

You are leaving our Medicare website and going to our non-Medicare website. If you do not intend to leave our site, close this message.

We’re bringing you to our trusted partner to help process your payments. This site has its own log in. It may be different from your Aetna secure member site log in.

La información a la que accederá es proporcionada por otra organización o proveedor. Si tu intención no era salir del sitio web, cierra este mensaje.

Caremark.com is the secure website where Aetna Medicare SilverScript members can manage prescriptions, sign up for mail delivery, view order status, find drug pricing, and identify savings options.

Our plan selection pages will be down for maintenance starting Friday, April 16, at 9 p.m. and returning by 1 p.m. Saturday, April 17.

The Appointment of Representative form is on CMS.gov. To view the form just select “Continue”. If you do not intend to leave Aetna Medicare, close this message.

You are leaving our Aetna Medicare website and going to an Aetna Medicaid website. If you do not intend to leave the Medicare site, close this message.

Fifteen minutes have passed since you took an action on this page. To protect your privacy, we will log you out in 2 minutes.

Resources For Living is not available for members with Aetna Part D (prescription only) plans, Dual Eligible Special Needs Plans (D-SNPs), Institutional Special Needs Plans (I-SNPs) or Medicare Supplement plans.

These examples are based on the actual experiences of members who have used Resources For Living. We’ve changed their names and some details to help protect their identities.

These examples are based on the actual experiences of members who have used Resources For Living. We’ve changed their names and some details to help protect their identities.